Advertisement|Remove ads.

Why Is First Solar Stock Gaining Premarket Today?

- According to TheFly, Roth analysts kept a ‘Buy’ rating on the stock and raised the price target to $270 from $225.

- The brokerage stated that the poly 232 announcement, expected by the middle of November, offers a "strong near-term catalyst to drive the stock higher."

- Roth analysts reportedly saw "no shortage of policy tailwinds" to support the bull narrative around First Solar.

First Solar (FSLR) stock rose over 3% in premarket trading on Monday after Roth Capital turned more bullish on its shares.

According to TheFly, Roth analysts kept a ‘Buy’ rating on the stock and raised the price target to $270 from $225. The new price target implied 13.9% upside from the stock’s previous close on Friday.

Why Did Roth Raise The PT?

The brokerage said that while the company's bookings could be light, the poly 232 announcement expected by the middle of November offers a "strong near-term catalyst to drive the stock higher." The brokerage was referring to the Section 232 import tariffs on polysilicon and its derivatives, a key material in solar panels.

A Tariff Rate Quota (TRQ) is widely anticipated to be implemented through Section 232. This would allow a certain amount of each targeted product to enter the U.S. annually before duties are applied. The expedited efforts come amid recent trade tensions between the U.S. and China, which, however, showed signs of easing on Sunday.

U.S. solar project developers are increasingly buying First Solar’s panels, which use cadmium telluride rather than the more common crystalline silicon used by most manufacturers, including those in China.

Roth analysts reportedly saw "no shortage of policy tailwinds" to support the bull narrative around First Solar. The brokerage hoped that the firm would provide updates on progress toward finishing lines and on mitigating tariff headwinds.

What Is Retail Thinking?

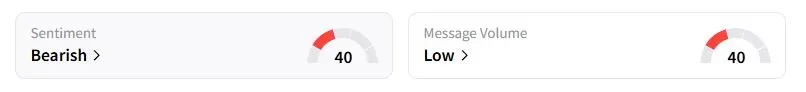

Retail sentiment on Stocktwits about First Solar was still in the ‘bearish’ territory at the time of writing.

What Do Analysts Expect From Q3 Earnings?

First Solar is scheduled to report its earnings on Oct. 30 after the markets close. Wall Street expects the firm to report earnings of $4.30 per share on revenue of $1.56 billion for the three months ended Sept. 30.

Earlier in October, Needham analysts said that they view First Solar as one of the "most policy-advantaged ways" to play U.S. utility-scale solar following the One Big Beautiful Bill. The brokerage also saw a spike in the company's free cash flow in 2026, creating "optionality" for platform expansion and capital returns.

Also See: Gold Miners Retreat After Bullion Slips As US-China Agree To Framework Of A Trade Agreement

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1903197985_jpg_2c45018acb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)