Advertisement|Remove ads.

This Rare Earth Stock Just Got A Big Wall Street Vote

- The investment bank reportedly highlighted MP Materials’ position as the largest rare earth producer in the Western Hemisphere, with a focus on neodymium-praseodymium (NdPr) oxide.

- The Las Vegas-based company reported a net loss of $41.8 million, or $0.24 per share, for the third quarter, compared with a loss of $11.2 million, or $0.16 per share.

- MP CEO Jim Litinsky was upbeat about the company’s growth prospects and referred to the tussle between the U.S. and China as ‘Cold War 2.0’.

MP Materials (MP) stock gained 2% in premarket trading on Wednesday after Goldman Sachs initiated coverage of the rare earth producer with a ‘Buy’ rating.

According to Investing.com, Goldman Sachs analysts also maintained a $77 price target, implying a 31% upside from the stock’s Tuesday closing price.

What Did Goldman Sachs Analysts Say?

The investment bank reportedly highlighted MP Materials’ status as the top rare earth producer in the Western Hemisphere, with a focus on neodymium-praseodymium (NdPr) oxide, a critical component for permanent magnets used in electronics, electric vehicles, and defense systems.

Goldman Sachs reportedly stated that MP’s downstream expansion into refining and magnet production to position in a market where China-based producers currently control 90-95% of global output, according to U.S. Energy Information Administration estimates.

The firm also noted that MP Materials is set to become the largest vertically integrated rare-earth magnet supplier in North America, controlling over 90% of the continent’s NdPr production, positioning it to capture market share as domestic manufacturers diversify their supply chains.

What Are Stocktwits Users Thinking?

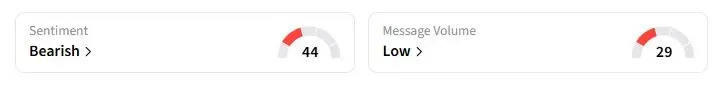

Retail sentiment on Stocktwits about MP Materials was in the ‘bearish’ territory at the time of writing.

The Las Vegas-based company reported a net loss of $41.8 million, or $0.24 per share, for the third quarter earlier this month, compared to a loss of $11.2 million, or $0.16 per share, a year earlier, as it grappled with the loss of revenue from the stoppage of sales of rare earth concentrate during the quarter. In previous quarters, these sales made up for most of the company's revenue. However, a July investment agreement with the U.S. military prevented any further shipments.

However, MP CEO Jim Litinsky was upbeat about the company’s growth prospects and referred to the tussle between the U.S. and China as ‘Cold War 2.0’. "Economic might itself, expressed through control of critical materials, advanced technologies, and the supply chains that sustain them, has become the decisive measure of national power," he said.

MP Materials' stock has more than tripled this year after the company received backing from the U.S. Department of Defense alongside Apple Inc.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)