Advertisement|Remove ads.

Why Is PBM Stock Drawing So Much Investor Interest Today?

- The company had initially set January 20 as the effective date of the reverse stock split, but delayed the move following additional internal review.

- The total outstanding shares have been reduced from about 6.39 million to roughly 1.02 million.

- This is Psyence Biomedical’s second reverse stock split action in eight months, following a 1-for-7.97 split on May 5.

Psyence Biomedical (PBM) stock was in the spotlight on Monday morning after its shares began trading on a post-reverse-split basis on the Nasdaq Capital Market on Monday.

PBM shares were up around 60% at the time of writing.

The company had initially set January 20 as the effective date of its 1-for-6.25 reverse stock split, but delayed the move following additional internal review.

Under the consolidation, each 6.25 existing share will be combined into one share, reducing the total outstanding shares from about 6.39 million to roughly 1.02 million. The reverse split was authorized by shareholders at a special meeting in April 2025, allowing the board to consolidate shares at a ratio of up to 1-for-50.

Second Reverse Split

Following the special meeting, Psyence Biomedical had implemented a 1-for-7.97 split on May 5, 2025, to increase the per-share trading price of its shares to meet Nasdaq’s $1.00 minimum bid price requirement.

Earlier this year, Psyence said its board approved a 2026 financial strategy that includes authorization for a potential share repurchase program to preserve capital for key clinical milestones. The company noted that its stock may be undervalued and that share repurchases could increase per-share ownership.

Last November, Psyence approved a $3.5 million follow-on investment in PsyLabs, a producer of purified psychedelic active pharmaceutical ingredients. The investment secures PsyLabs’ position as a critical supplier of GMP-grade psilocybin and ibogaine, supporting Psyence’s clinical pipeline.

How Did Stocktwits Users React?

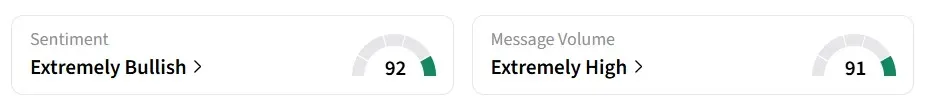

Retail sentiment for PBM on Stocktwits turned ‘extremely bullish’ from ‘bullish’ a session earlier, amid ‘high’ message volumes.

One Stocktwits user expects the stock to double in value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262656307_jpg_562c79e1bd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256305566_jpg_26cd17b56a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)