Advertisement|Remove ads.

Why Is Robinhood Stock Jumping Over 7% Premarket Today?

Robinhood stock (HOOD) rose 7.4% in premarket trading on Monday after the firm was inducted into the S&P 500 benchmark index.

The S&P Dow & Jones Indices said on Friday that the retail trading platform will replace Caesars Entertainment (CZR) in the flagship index. AppLovin and Emcor Group will also join the index, closely tracked globally, from Sept. 22.

The addition to the S&P 500 ends a long wait for Robinhood, with a market capitalization of nearly $90 billion, making it one of the most valuable firms to be excluded from the index. Following its induction, the company will attract a deeper pool of investors as the funds that track the index will adjust their holdings accordingly.

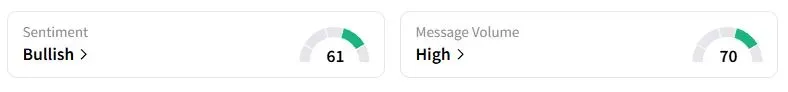

Retail sentiment on Stocktwits about Robinhood was in the ‘bullish’ territory at the time of writing.

“S&P 500 addition changes this stock completely. Now everyone’s 401(k) buys into it,” one user said.

Another user projected a 15% rise on Monday, on par with the gains of Palantir following its inclusion.

Robinhood’s inclusion marks another Wall Street endorsement for the financial technology sector. Earlier this year, cryptocurrency trading platform Coinbase was added to the S&P 500.

Robinhood stock has more than doubled this year amid a rally in cryptocurrency prices and volatility in equity markets, driven by uncertainty in tariff policies.

For the second quarter, its revenue jumped 45% year-over-year to $989 million, while net income more than doubled to $386 million. The company is also expanding beyond its core trading platform and bolstering wealth management offerings. Chief Financial Officer Jason Warnick said in July that Robinhood was venturing further into the lending business after getting positive feedback from members of its gold card regarding home loans.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)