Advertisement|Remove ads.

Why Is UPS Stock Gaining Premarket Despite A Downgrade?

United Parcel Services (UPS) stock rose 1.1% in premarket trading on Friday after the company scrapped its acquisition of Mexico’s Estafeta and rival FedEx’s upbeat earnings report.

The logistics firm revealed in a regulatory filing on Thursday that it was canceling the deal due to the inability to satisfy all closing conditions. UPS had said in February that it expected to close the deal in the first half of 2025.

It first revealed the agreement to buy the Mexican small package provider in July 2024. While UPS had not revealed the financial details of the deal, it had said that the acquisition would help it toward its goal to become the world's premium international small package and logistics provider.

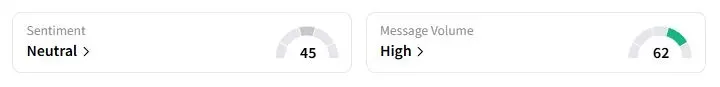

Retail sentiment on Stocktwits about UPS was in the ‘neutral’ territory at the time of writing.

Earlier this year, UPS unveiled a series of measures to rein in costs amid a volatile trade environment. The company aims to reduce its workforce by approximately 20,000 positions this year and close 73 leased and owned buildings by year-end. The parcel giant anticipates $3.5 billion in total cost savings from the measures.

“Bought in at $85. Bounce is inevitable. The dividend is just another reason to hold. Quality investment right here,” one user wrote on Stocktwits.

The stock was also likely getting a lift from rival FedEx’s fiscal first quarter earnings, as it topped Wall Street’s estimates on robust domestic demand and cost control measures.

However, UPS stock was downgraded by BMO analysts to ‘Market Perform’ from ‘Outperform’, according to The Fly. The brokerage also reportedly lowered the price target to $96 from $125.

BMO analysts noted that the company is not seeing a recovery in demand, especially in its "important" business-to-business segment, amid macro environment challenges and shifting U.S. trade policies.

UPS stock has fallen 33% this year, compared with a nearly 20% decline in FedEx stock.

Also See: Ray Dalio Warns 'End Of Entire US Empire' On $37 Trillion Debt Spiral As Spending Outpaces Revenue

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)