Advertisement|Remove ads.

FedEx Stock Gains After-Hours On Q1 Earnings Beat, Sees $1B Hit From Trade Volatility Unleashed By Trump Tariffs

FedEx stock gained 5.5% in extended trading on Thursday after the parcel delivery giant topped Wall Street’s estimates for fiscal first-quarter profit.

On an adjusted basis, the company posted earnings of $3.83 per share for the quarter ended Aug. 31, while analysts expected it to post earnings of $3.61 per share, according to fiscal.ai data. The company’s quarterly revenue of $22.2 billion also topped the estimated revenue of $21.65 billion.

The company noted that higher U.S. domestic and international priority package yields, increased U.S. domestic package volume, and cost-cutting initiatives drove the growth in earnings. The company has set a goal of achieving $1 billion in cost savings for the fiscal year 2026, through grounding planes, closing facilities, and merging some of its subsidiaries.

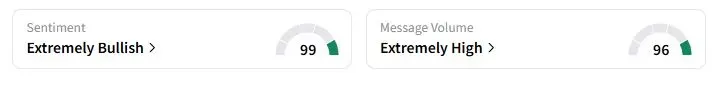

Retail sentiment on Stocktwits about FedEx moved higher into the ‘extremely bullish’ territory at the time of writing.

“These factors were partially offset by higher wage and purchased transportation rates, the impact of the evolving global trade environment on international export package demand, and the expiration of the U.S. Postal Service contract,” FedEx said.

The company added that it expects to take a $1 billion hit due to global trade uncertainty, out of which $300 million is related to expenses such as customs clearance costs.

FedEx and its peer UPS are reeling from the dynamic tariff policy of the Trump administration, which has impacted demand in some areas. They have also taken a hit as the Trump administration has moved to end the de minimis exemption, a trade policy that allowed low-value imported goods valued below $800 to enter the United States without companies having to pay customs duties or taxes.

The de minimis exemption was widely used by fast-fashion companies such as Temu and Shein, which used to ship their products in small batches.

“We're doing everything in our power to make sure that we can improve our customer experience and mitigate the costs as we move forward,” CEO Raj Subramaniam said during a call with analysts.

One Stocktwits user projected that the stock could open at $260 on Friday.

FedEx also forecasted fiscal 2026 adjusted earnings between $17.20 and $19.00 per share, slightly below analysts’ expectations.

FedEx stock has fallen 19.6% this year.

Also See: BofA Securities Resolves DoJ Investigation Into ‘Cash’ Market Manipulation By Former Employees

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)