Advertisement|Remove ads.

INVO Fertility’s 350% Spike Puts Microcap IVF Stocks Back On Retail Radar

- Last month, INVO Fertility signed a definitive agreement to acquire Family Beginnings, a fertility clinic.

- INVO Fertility also announced a private placement worth $4 million last month.

- Terah Krigsvold recently took over as IVF’s chief financial officer, replacing Andrea Goren.

INVO Fertility, Inc. (IVF) shares drew significant retail interest on Tuesday, with the stock soaring 350% in premarket trading.

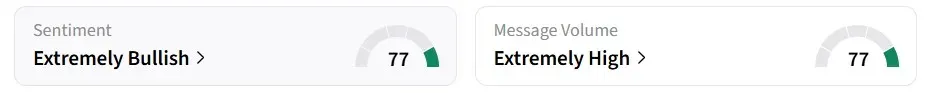

Retail watchers for IVF stock increased a whopping 726% over the last 24 hours and 3,700% over seven days, according to Stocktwits data. Retail sentiment on Stocktwits was ‘extremely bullish’ over the past 24 hours, accompanied by ‘extremely high’ message volumes.

A few users speculated on U.S. President Donald Trump cutting costs for fertility treatments.

While others saw a classic pump-and-dump scheme.

The speculation stems from an October 2025 report on Trump and Merck’s agreeing to reduce the cost of drugs used in in vitro fertilization. Merck’s U.S. unit, EMD Serono, will sell key fertility treatments directly to patients, offering up to an 84% discount when the drugs are used together.

Why Has Retail Been Tracking IVF?

Last month, INVO Fertility signed a definitive agreement to acquire Family Beginnings, P.C., a fertility clinic serving Indiana and the broader Midwest. The deal allows INVO to strategize to expand its network of fertility care centers across the United States.

INVO will acquire the non-clinical assets for $750,000, consisting of $350,000 in cash at closing, net of a $150,000 holdback, and $400,000 in Series D non-voting convertible preferred stock. Family Beginnings generated approximately $1.2 million in revenue and $0.2 million in net income over the past year.

Prior to that, INVO Fertility announced a private placement with a single institutional investor to sell 2.37 million shares, or pre-funded warrants, along with warrants for up to 4.73 million additional shares, at an effective price of $1.69 per share. The offering generated around $4 million in gross proceeds.

Recently, Terah Krigsvold, who has served as INVO’s controller since December 2020, was appointed the Company’s CFO, replacing Andrea Goren. INVO Fertility also implemented a one-for-eight reverse stock split on Nov. 28, 2025.

Read also: IBRX Stock Extends Rally On FDA Feedback For ANKTIVA Bladder Cancer Filing

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_war_jpg_f2a208ae56.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)