Advertisement|Remove ads.

Why NVAX Stock Is Popping Pre-Market – And What Does Pfizer Have To Do With It?

- The deal provides Novavax with an upfront payment of $30 million, along with the opportunity to earn up to $500 million in additional development and sales milestones.

- Matrix-M adjuvant is a proprietary vaccine ingredient, used in several marketed vaccines to improve effectiveness and help the immune system better recognize and remember disease targets.

- Novavax is eligible to receive tiered royalties in the high mid-single digit range on sales of any Pfizer products that use Matrix-M.

Novavax, Inc. (NVAX) shares climbed 6% higher in pre-market trading on Tuesday after the company signed a licensing agreement with Pfizer, granting the pharmaceutical giant non-exclusive rights to use Novavax’s Matrix-M adjuvant in up to two disease areas.

Matrix-M adjuvant is a proprietary vaccine ingredient that improves the body’s immune response. It is made from naturally derived compounds and is used in several marketed vaccines to improve effectiveness and help the immune system better recognize and remember disease targets, according to Novavax.

What Is The Novovax-Pfizer Deal?

The deal provides Novavax with an upfront payment of $30 million, along with the opportunity to earn up to $500 million in additional development and sales milestones. Novavax is also eligible to receive tiered royalties in the high mid-single digit range on sales of any Pfizer products that use Matrix-M.

Under the agreement, Pfizer will take full responsibility for the development and commercialization of its products, while Novavax will supply the Matrix-M adjuvant. The partnership strengthens Novavax’s long-term revenue potential.

This comes after Novavax completed the transfer of U.S. and European marketing authorizations for its COVID-19 vaccine, Nuvaxovid, to Sanofi in November. The move resulted in a second $25 million milestone payment to Novavax, following the completion of the European Union marketing authorization transfer in October 2025.

Novavax is expected to receive additional milestone payments and royalties tied to Nuvaxovid, Sanofi-developed combination products, and new vaccines that use Novavax’s Matrix-M adjuvant. Novavax also has long-standing partnerships with Japan’s Takeda and the Serum Institute of India.

How Did Stocktwits Users React?

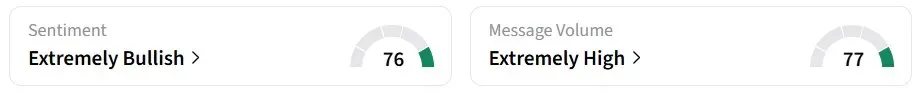

Retail sentiment for NVAX on Stocktwits remained in the ‘extremely bullish’ zone, amid ‘extremely high’ message volumes. NVAX was also among the top three trending tickers on the platform at the time of writing.

One bullish user said that the stock is undervalued.

Another user was bullish about Matrix-M’s market potential.

The stock has declined around 6% over the past year.

Read also: INVO Fertility’s 350% Spike Puts Microcap IVF Stocks Back On Retail Radar

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)