Advertisement|Remove ads.

Redwire Stock Surged 12% Pre-Market Today — What’s Fueling The Rally?

- The SHIELD contract spans a wide range of potential projects aimed at modernizing homeland defense.

- The SHIELD IDIQ program is managed by the U.S. Missile Defense Agency.

- Last month, Redwire agreed to provide two International Docking System Standard-compliant docking systems for the Exploration Company (TEC).

Redwire Corp. (RDW) announced on Tuesday that it has been selected as a participant in a major U.S. Department of Defense contract that could reach up to $151 billion in value.

The award positions Redwire alongside other suppliers within a broad Missile Defense Agency program intended to accelerate the delivery of innovative capabilities to military end users.

Contract Details

The multi-award indefinite delivery/indefinite quantity (IDIQ) agreement, known as the Scalable Homeland Innovative Enterprise Layered Defense (SHIELD) contract, spans a wide range of potential projects designed to support homeland defense modernization.

The SHIELD IDIQ program is managed by the U.S. Missile Defense Agency and is designed to give the government flexibility in procuring next-generation systems without guaranteeing specific contract amounts.

After the announcement, Redwire stock traded over 12% higher in Tuesday’s premarket.

What Are Stocktwits Users Saying

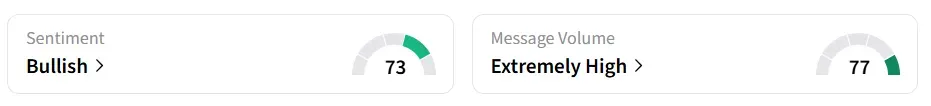

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory while message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

A bullish Stocktwits user commended the contract win.

Another user expressed optimism about multiple bidding angles for revenue under the broad program.

“Redwire’s proven space and defense technologies, including unmanned aerial systems, advanced sensors, maneuverable spacecraft platforms, and agent-based modeling and simulation, position us to deliver resilient, multi-domain solutions for national security missions.”

-Peter Cannito, Chairman and CEO, Redwire

Space Tech Gains Momentum

Redwire is a space and defense tech company focused on aerospace infrastructure, autonomous systems, and multi-domain operations, making use of digital engineering and AI automation.

The stock gained momentum after President Trump signed a sweeping space policy executive order in December, launching an ambitious blueprint to reinforce America’s dominance in space exploration and setting aggressive goals for lunar missions, space security enhancements, and private-sector growth.

Last month, Redwire agreed to provide two International Docking System Standard-compliant docking systems for the Exploration Company (TEC). RDW stock has declined by over 49% in the last 12 months.

Also See: Why Did BZAI Stock Surge 24% Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)