Advertisement|Remove ads.

Tata Investment Share Price Adjusts After First-Ever Stock Split

Tata Investment shares opened at ₹1,042 a piece on Tuesday, after closing at ₹9,922 in the previous session. However, despite appearing to crash by 90%, shares actually gained around 7%.

This is due to a price adjustment reflecting the higher number of shares available in the market following the company’s first-ever stock split.

What Is A Stock Split?

On September 22, Tata Group’s holding and investment arm set October 14 as the record date for its 1:10 stock split, dividing one share of ₹10 face value into ten shares of ₹1 each. The company first approved the sub-division of shares on August 04.

A stock split increases the number of shares while proportionally reducing the share price, keeping the total value of the investment unchanged.

For example, 100 shares worth ₹1 lakh would become 1,000 shares after the split, but the overall investment value will remain the same.

Who Are Eligible To Benefit From The Split?

Only investors who held shares as of close on October 13 were eligible to receive the split shares. Investors purchasing the stock on October 14 will not qualify.

The move is intended to improve liquidity and make the shares more accessible to a broader base of investors.

Decent Q1 Print

Tata Investment posted an 11.6% increase in consolidated net profit at ₹146.3 crore for the first quarter. Revenue from operations came in at ₹145.46 crore, marginally higher than the ₹142.46 crore it reported a year earlier.

Stock Watch

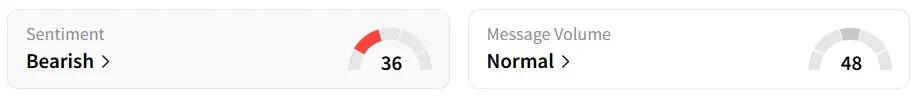

Retail sentiment has remained ‘bearish’ on Stocktwits. It was ‘neutral’ last week.

At the time of writing, Tata Investment shares were trading 6.15% higher at ₹1,053.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)