Advertisement|Remove ads.

Will Nio Stock Extend Its Winning Streak? Goldman Boosts Stake But ES8 Demand Raises Concerns

- Goldman Sachs disclosed a 57% increase in its stake, rebuilding exposure as the stock rallied near a two-year high in October.

- ES8 delivery wait times have been shrinking, with lead times cut to 8-9 weeks as production surged.

- The company is targeting full-year non-GAAP profits after guiding for adjusted operating profit of 700 million to 1.2 billion yuan in Q4.

Shares of Nio, Inc. jumped over 2% on Wednesday, extending their rally to a second straight session, after a new filing showed Goldman Sachs increased its stake in the Chinese EV maker, even as shrinking delivery wait times for Nio’s flagship ES8 raise questions about demand momentum.

Goldman Rebuilds Position After Pullback

Goldman disclosed on Tuesday that it lifted its Nio holdings by 57% in the fourth quarter of 2025 with about 14.4 million shares worth roughly $73 million. Goldman’s position had peaked above 32 million shares in 2022 before falling to just 1.8 million shares in early 2025. The latest increase places the bank among Nio’s top institutional holders once again, though well below prior highs.

The increase in Goldman's exposure came as Nio’s U.S.-listed shares rallied to near a two-year high in October after the company reported record September deliveries of 34,749 vehicles, driven by strong momentum from its Onvo and Firefly brands.

Shrinking ES8 Wait Times

Meanwhile, Nio has cut ES8 delivery wait times to 8-9 weeks, down sharply from as long as six months at launch. The faster delivery pace reflects a major production ramp, with output rising from under 300 vehicles per day in September to more than 800 at peak, according to a report by EV.

However, wait times continued to shrink even as January deliveries fell more than 20% from December levels. This has raised concerns over whether production is now running ahead of new orders, or whether the initial surge of launch demand has largely been absorbed.

Beyond China, Nio is pressing ahead in Europe. The company recently named DHL as its logistics partner for aftermarket services across Northwestern Europe.

Nio Lays Out Path To Full-Year Profitability

Recently, CEO William Li outlined plans to its employees on sustaining delivery momentum, tightening costs and hitting annual non-GAAP profitability following the company’s first projected profitable quarter.

Nio previously guided for adjusted operating profit of 700 million to 1.2 billion yuan for the fourth quarter of 2025, a turnaround from losses a year earlier, supported by stronger deliveries, improved product mix and cost discipline. He pointed to momentum in the ES8, Onvo L90 and Firefly models as key drivers, while emphasizing operational efficiency, R&D discipline and battery-swap expansion as key to sustaining margins into 2026.

How Did Stocktwits Users React?

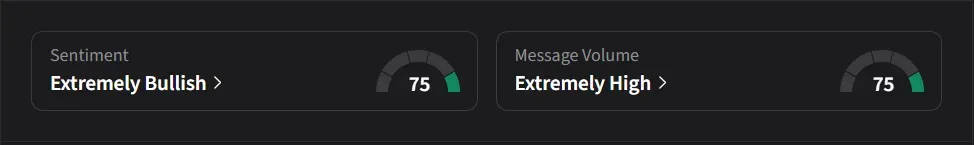

On Stocktwits, retail sentiment for Nio was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said, “I think maybe there's a chance by let's say 2028 or 2029 Nio could be at $60 plus”

Another user expects the stock to “go up about 15.00 dollars plus”

U.S.-listed shares of Nio have risen 26% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)