Advertisement|Remove ads.

Wingstop Shares Close Higher On Q4 Earnings Beat — Analyst Flags ‘Too Optimistic’ Guidance

- TD Cowen reiterated a ‘Hold’ rating and $285 price target on WING shares.

- The analyst also modestly raised Wingstop's 2026 same-store sales forecast to 0.5% higher, compared to a 0.5% decline that it expected previously.

- Wingstop said it expected flat to low-single digit domestic same-store sales growth for 2026, compared to a 5.8% drop in 2025.

Shares of American fast food chain Wingstop Inc. (WING) ended Wednesday’s trading session more than 10% up after the company reported higher-than-expected earnings in the fourth-quarter (Q4) of 2025.

The company said it expected flat to low-single digit domestic same-store sales growth for 2026, compared to a 5.8% drop in 2025.

However, analyst TD Cowen flagged the risk of its guidance "proving too optimistic," adding that it sees a similar dynamic for the upcoming year as 2025.

Analyst Concern

TD Cowen modestly raised Wingstop's 2026 same-store sales forecast to 0.5% higher, compared to a 0.5% decline that it expected previously, according to TheFly.

The analyst said that it revised its estimate after the company's "better than feared" Q4 results. However, the analyst flagged that underlying challenges persist for the restaurant operator despite its Q4 results. TD Cowen reiterated a ‘Hold’ rating and $285 price target on WING shares.

Meanwhile, according to data from Koyfin, WING shares have an average 12-month price target of $324.21 based on 31 estimates. This indicates an upside potential of about 16% from its previous close.

24 out of 31 analysts covering the stock have a ‘Buy’ or higher rating.

Earnings Snapshot

Wingstop posted total revenues of $175.7 million in Q4, an increase of 8.6% compared to the same quarter in 2024, although lower than street expectations of $177.36 million, as per Fiscal.ai data.

The company posted diluted earnings per share of $0.96, above street expectations of $0.83. For fiscal year 2026, Wingstop forecasted a global unit growth rate of 15% to 16%.

How Did Stocktwits Users React?

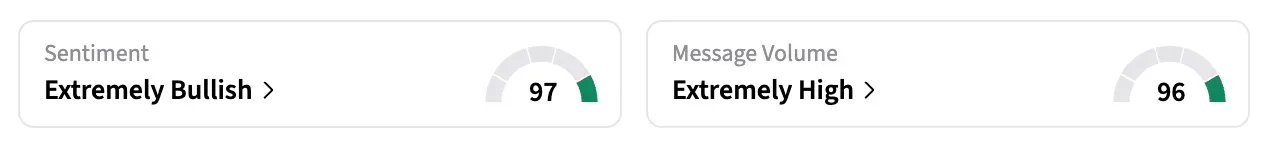

On Stocktwits, retail sentiment around WING shares remained in the ‘extremely bullish’ territory over the past 24 hours amid ‘extremely high’ message volumes.

Shares of the company have declined more than 8% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also Read: Fiverr Shares Slide After Earnings Miss Triggers Wall Street Downgrade, Target Cut

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1234770702_jpg_792acca270.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239899916_jpg_cde8ab32f4.webp)