Advertisement|Remove ads.

Wipro Bets Big on AI-Led Engineering with Harman DTS Acquisition

Wipro is set to acquire Harman’s digital transformation solutions (DTS) business unit for $375 million. The acquisition will significantly strengthen Wipro’s Engineering Research and Development (ER&D) services.

ER&D Portfolio Boost

The deal strengthens Wipro’s ER&D portfolio by expanding its AI-driven digital and device engineering expertise and enabling end-to-end solutions, from design through manufacturing for clients in technology, industrials, aerospace, healthcare, and consumer markets.

Wipro plans to integrate DTS into its Engineering Global Business Line, further boosting its innovation and service capabilities. The DTS business enhances Wipro’s digital engineering, connected products, and advanced software platforms.

Harman To Streamline Business

For Harman, a unit of Samsung, the divestment will allow it to focus on core strengths in automotive electronics and audio technology, sectors where it foresees significant growth opportunities.

Deal Details

The deal, expected to close by December 31, 2025, will bring more than 5,600 DTS employees, including senior leadership across the Americas, Europe, and Asia, into Wipro’s fold. Deutsche Bank Securities served as the financial advisor to HARMAN in this transaction.

Brokerages Offer Mixed Views

Brokerages view Wipro’s latest acquisition as a key strategic step in strengthening its digital engineering and AI-led portfolio.

Nomura, which has a ‘buy’ rating with a target price of ₹310, believes the deal will significantly enhance Wipro’s design-to-manufacturing capabilities. It estimates the acquisition could add 280 basis points to the company’s revenues by FY27.

Morgan Stanley, however, maintained an ‘equal weight’ stance with a price target of ₹285. The brokerage noted that while the deal could lift Wipro’s ER&D revenue by around 10%, it may prove margin-dilutive and have a neutral to slightly negative impact on earnings per share in FY27.

HSBC adopted a cautious view with a ‘hold’ rating and a price target of ₹260. The brokerage expects client challenges in Europe and leadership changes to be behind the company, with recovery prospects improving from the second half of FY26.

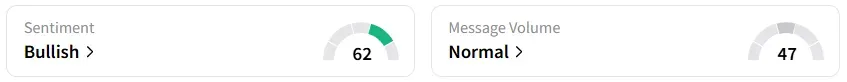

Retail View

Wipro was among the top 3 trending stocks on Stocktwits in early trade. Retail sentiment on the platform remained ‘bullish’. It was ‘bearish’ a week ago.

At the time of writing, Wipro’s shares were largely unchanged at ₹250, having lost over 16% this year.

Wipro reported a 10.9% increase in its Q1 net profit at ₹3,336.5 crore, while its revenue from operations grew slightly to ₹22,134.6 crore from ₹21,963.8 crore.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)