Advertisement|Remove ads.

WK Kellogg Stock Pops After-Hours As Candy Maker Ferrero Reportedly Nears $3B Deal To Buy Cereal Company

WK Kellogg (KLG) shares rocketed 55% in after-market trading on Wednesday, after a report said that Italy's Ferrero was close to signing a $3 billion deal to buy the American cereal company.

The Wall Street Journal reported, citing people familiar with the matter, that the deal could be finalized as early as this week. WK Kellogg, the company behind Froot Loops, Frosted Flakes, and Rice Krispies, has a market value of approximately $1.5 billion and more than $500 million in debt.

The deal would combine two of the world's best-known consumer food makers.

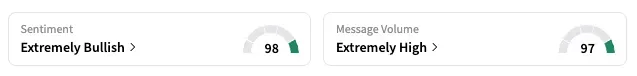

On Stocktwits, the retail sentiment for WK Kellogg jumped to nearly the highest possible level ('extremely bullish' 98/100).

The deal "is going to puff a little hopium into owners of other consumer companies that have had their shares destroyed recently," a user said, suggesting that more struggling consumer food companies would now consider mergers and acquisitions.

As of their last close, WK Kellogg shares were down 3.3% year-to-date.

Privately owned Ferrero, known for its Ferrero Rocher chocolates and Nutella peanut butter, has been making acquisitions in North America to expand both geographically and in categories.

It bought ice cream maker Wells Enterprises and, before that, struck a $2.8 billion deal to acquire Nestlé's U.S. chocolate business.

Cereals-focused WK Kellogg was spun off into a publicly listed company two years ago. The snacking business, called Kellanova, was bought by Mars for more than $30 billion last year.

The development comes as WK Kellogg has been struggling with weak demand for its cereal and is under scrutiny for using artificial food colorants.

Recent deals in the consumer foods space include PepsiCo's (PEP) acquisition of tortilla-chip maker Siete Foods, J.M. Smucker's (SJM) acquisition of cake maker Hostess Brands, and Hershey's deal for popcorn brand LesserEvil.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_39d73f48c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212776621_jpg_54c763cf43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)