Advertisement|Remove ads.

Wolfspeed Grabs Retail Spotlight As Stock Rockets 25% On $1.5B Financing From US, Private Investors

Shares of Wolfspeed, Inc. ($WOLF), a leading manufacturer of chips primarily used in electric vehicles (EVs), surged over 25% on Tuesday after the company announced major funding news.

Wolfspeed is set to receive $750 million in U.S. government grants and an additional $750 million in financing led by Apollo Global Management to support its expansion efforts.

“Together these investments support Wolfspeed’s long-term growth plans and bolster domestic production of silicon carbide to power clean energy systems underpinning electric vehicles (EVs), artificial intelligence (AI) data centers, battery storage and more,” the company said in a statement.

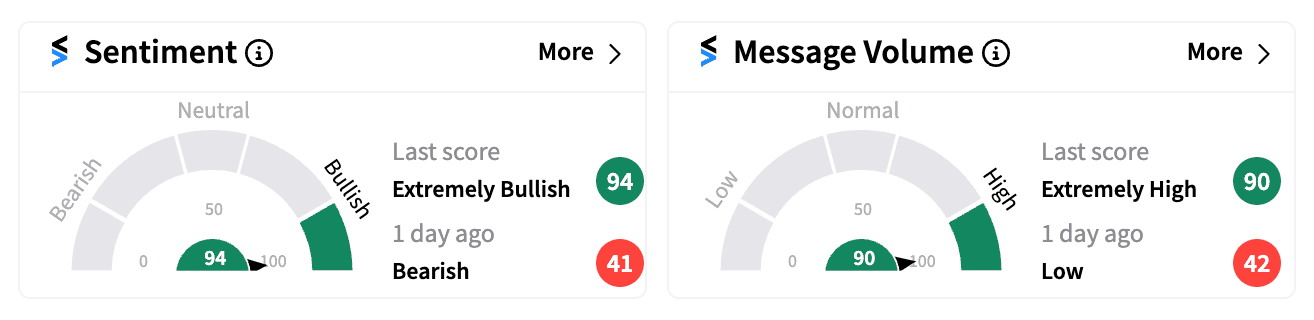

WOLF quickly became the top-trending ticker on Stocktwits, with retail sentiment turning ‘extremely bullish’ as of 10 a.m. ET.

The company, which describes itself as “the world’s largest producer of silicon carbide technology,” counts major automakers like General Motors and Mercedes-Benz among its customers.

“As a key player in the semiconductor industry, this proposed investment will enable us to solidify our leadership position with a first-of-its-kind 200mm silicon carbide manufacturing footprint in upstate New York and central North Carolina, while contributing to the resilience and competitiveness of the U.S. supply chain,” Wolfspeed CEO Gregg Lowe said.

Wolfspeed has reportedly faced production challenges, especially at its chip plant in Mohawk Valley, New York, forcing it to rely on an older, more expensive facility.

The company hasn’t posted an annual profit in over a decade, with its last quarter of positive net income in 2018, according to Bloomberg.

The U.S. government’s $750 million grant stems from the 2022 CHIPS and Science Act, and will help cover part of Wolfspeed’s $6 billion-plus planned factory investments in North Carolina and New York.

Additionally, Wolfspeed expects to receive around $1 billion in Section 48D cash tax refunds from the IRS over the coming years.

WOLF stock remains down more than 60% year-to-date.

Read next: WBA Stock Climbs On Plan To Close Thousands of Stores: Retail Is Betting On A Comeback

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)