Advertisement|Remove ads.

WBA Stock Climbs On Plan To Close Thousands of Stores: Retail Is Betting On A Comeback

Shares of Walgreens Boots Alliance Inc. ($WBA) surged more than 5% pre-market Tuesday after the company reported better-than-expected earnings and revealed a significant store closure plan.

Walgreens earned $0.39 per share on an adjusted basis in its fiscal fourth quarter, exceeding analysts’ average estimate of $0.36 per share.

The company’s revenue climbed 6% year-over-year to $37.5 billion, topping expectations of $35.8 billion.

In addition to its earnings beat, Walgreens announced a three-year “footprint optimization program” targeting approximately 1,200 store closures — about 14% of its U.S. locations — including 500 closures planned for fiscal 2025.

The company believes this move will be immediately accretive to adjusted earnings per share (EPS) and free cash flow.

“Fiscal 2025 will be an important rebasing year as we advance our strategy to drive value creation. This turnaround will take time, but we are confident it will yield significant financial and consumer benefits over the long term,” said CEO Tim Wentworth.

Walgreens provided a fiscal 2025 earnings forecast of $1.40 to $1.80 per share, against a consensus estimate of $1.72.

For full-year sales, the company expects revenue between $147 billion and $151 billion, aligning with analysts’ expectations of $147.6 billion.

The company’s U.S. healthcare and international businesses are expected to grow, while its U.S. retail pharmacy division is projected to face continued challenges.

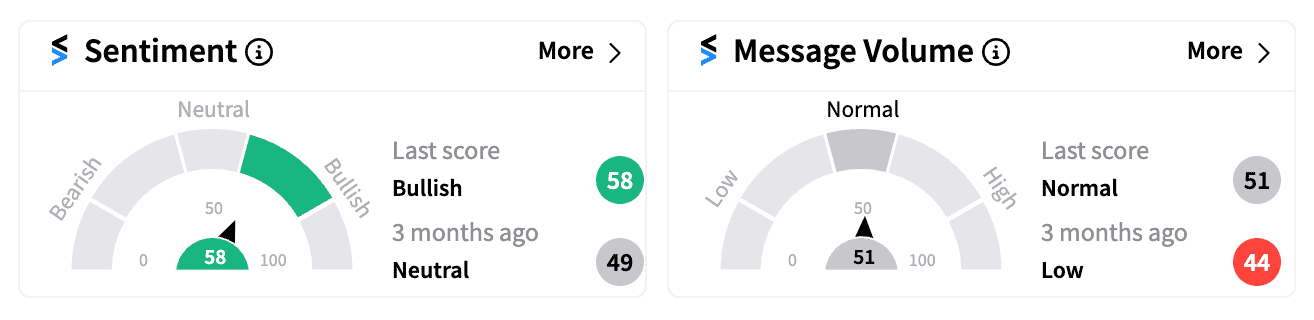

On Stocktwits, retail sentiment for WBA turned ‘bullish’ in pre-market trading, with a noticeable increase in message volume.

Earlier, CEO Wentworth had warned that headwinds would persist into 2025 as the retail pharmacy division faces stiff competition from e-commerce giants like Amazon and discount retailers such as Dollar General and Costco.

WBA stock is still down more than 66% year-to-date.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1470886126_jpg_f11dd80298.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)