Advertisement|Remove ads.

El-Erian Says Whiplash In December Fed Rate Cut Expectations Is Stunning – Cites Four Key Factors, Including ‘Lame Duck Chair’

- El-Erian said market expectations for the Fed’s December decision have swung far more sharply than usual.

- He linked the instability partly to the government shutdown, which disrupted key economic data.

- The economist also said the Fed is facing a “dual-mandate squeeze,” complicating its policy path.

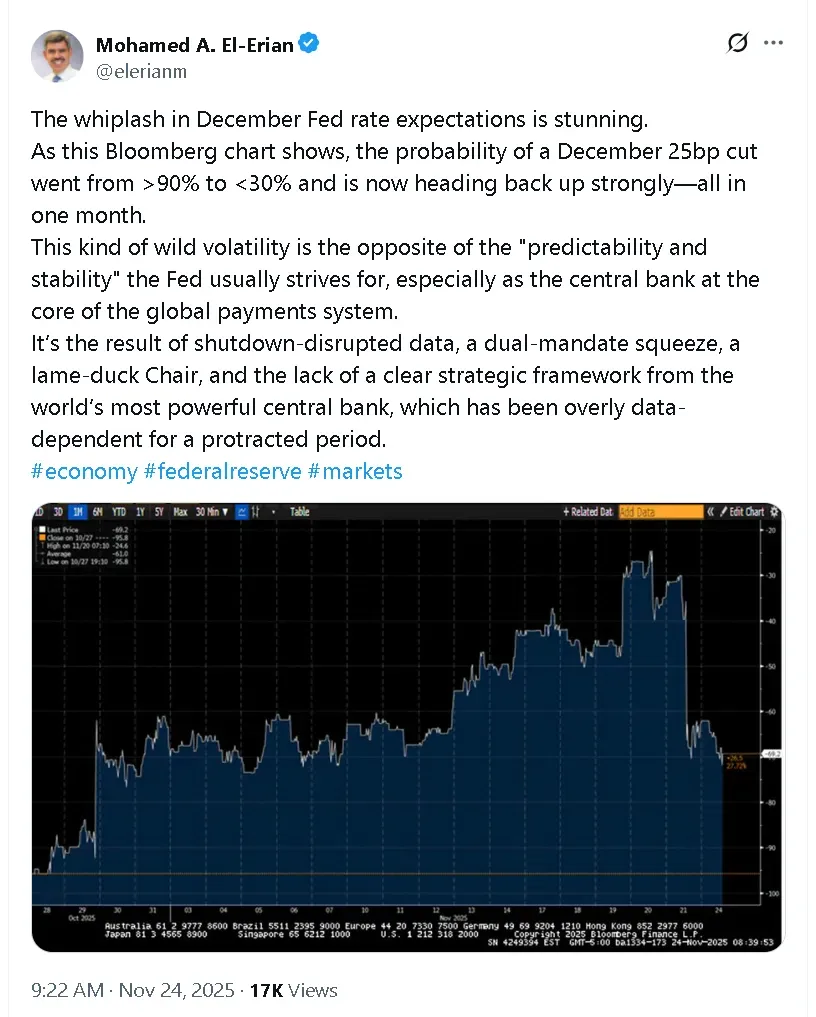

Mohamed El-Erian, Chief Economic Advisor at Allianz, said on Monday that U.S. markets have experienced a “whiplash” in expectations for the Federal Reserve’s December interest rate decision.

In a post on X, he described the volatility as atypical for the central bank, which traditionally aims for “predictability and stability,” given the Fed’s role in the global payments system.

Shutdown Fallout Clouds Fed Signals

El-Erian attributed the erratic market swings to a combination of factors. “It’s the result of shutdown-disrupted data, a dual-mandate squeeze, a lame-duck Chair, and the lack of a clear strategic framework from the world’s most powerful central bank, which has been overly data-dependent for a protracted period,” he wrote.

The market has been struggling to interpret incoming signals after the record U.S. government shutdown earlier this month halted work at multiple agencies. On Friday, the U.S. Bureau of Labor Statistics (BLS) said it canceled the release of October’s consumer price report after the shutdown prevented data collection.

Rate-Cut Odds Rebound After Sharp Weekly Swings

The CME Group’s FedWatch Tool showed a 77% probability of a 25 basis points (bps) cut in December as of midday Monday. That compares with roughly 41% last Thursday, when minutes from the October Federal Open Market Committee (FOMC) meeting signaled hesitation among officials about cutting rates again this year.

Investors are now focused on fresh macroeconomic data expected on Thursday, including U.S. retail sales and producer prices, for direction on inflation and demand.

U.S. equities traded higher during Monday morning. The SPDR S&P 500 ETF (SPY) was up 0.98%, the SPDR Dow Jones Industrial Average ETF (DIA) gained 0.30%, and the Nasdaq-100 tracking Invesco QQQ Trust (QQQ) moved 1.70% higher. Retail sentiment around QQQ on Stocktwits improved to ‘neutral’ from ‘bearish’ territory over the past day, accompanied by ‘high’ levels of chatter.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)