Advertisement|Remove ads.

Workday Stock Slides Despite Earnings Beat As Wall Street Turns Cautious On Outlook: Retail Turns Extremely Bullish

Shares of software vendor Workday Inc. (WDAY) declined 7.5% in Friday’s premarket session after the company posted a worse-than-expected outlook for the second quarter.

The firm’s first-quarter (Q1) revenue grew 12.6% to $2.24 billion, slightly exceeding the analysts’ consensus estimate of $2.21 billion, per Finchat data.

The adjusted earnings per share (EPS) of $2.23 also beat the consensus estimate of $2.01.

However, Workday said it anticipates a subscription revenue of $2.160 billion for the second quarter (Q2). The outlook was not well received by Wall Street analysts.

Stifel cut its price target on Workday to $275 from $310 while maintaining a ‘Hold’ rating.

The firm noted that although Workday posted a standard quarterly beat on both revenue and margins, the stock declined in after-hours trading.

This was due to 15.6% current remaining performance obligation (cRPO) growth landing mid-range of guidance and being boosted by approximately 50 basis points from short-term "tenant" contracts, which had not typically been included in cRPO.

Stifel also commented that with subscription and bookings growth likely to stay in the mid-to-low teens over the next few quarters, operating margin improvements alone are unlikely to expand the stock’s valuation multiple significantly.

Oppenheimer reduced its price target to $300 from $320 but maintained an ‘Outperform’ rating on the stock, noting that Workday’s Q1 results demonstrated solid improvements in margins and cRPO.

However, the firm said these strengths were tempered by indications of an ongoing slowdown in Q2 and only slight adjustments to forecasts based on management's guidance.

Loop Capital cut its price target to $250 from $285 while maintaining a ‘Hold’ rating.

In a research note, the brokerage described the company’s revenue performance as ‘lackluster,’ with Q2 guidance mostly in line, indicating the business is under pressure but has generally stabilized.

Loop also noted that Q1 cRPO growth slightly exceeded expectations, helped by a stronger-than-anticipated boost from ‘tenant’ contracts, which hadn’t been factored into the original cRPO forecast.

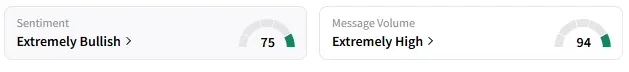

However, on Stocktwits, retail sentiment around Workday changed to ‘extremely bullish’ from ‘bullish’ the previous day.

Workday stock has gained 5.4% year-to-date and 4.3% in the last 12 months.

Also See: Apple Retail Traders Lose Faith As Market-Cap Trails Microsoft, Nvidia Amid 7-Day Losing Streak

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)