Advertisement|Remove ads.

Beyond Air Stock Rises Ahead Of Earnings: Retail Bullish

Beyond Air ($XAIR), a medical device and biopharmaceutical company focused on developing treatments for lung diseases, saw its shares rise 6% (2:06 pm ET) ahead of its second-quarter earnings, lifting retail sentiment on Stocktwits.

The commercial-stage medical device and biopharmaceutical company is expected to report a net loss per share of $0.28 on revenue of $1.03 million by Wall Street analysts. The company beat EPS estimates last quarter by 14.80%, posting a loss per share of $0.27. It has beaten consensus estimates three times in the last four quarters and re-issued revenue guidance of at least $10 million for FY 2025 in August.

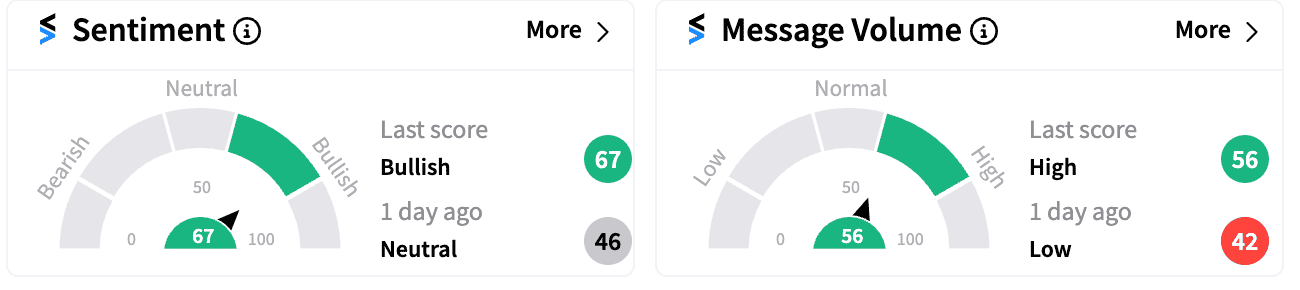

Retail sentiment on the company inched up on Monday, rising to ‘bullish’ (67/100) from ‘neutral’ (46/100) a day ago as message volumes rose from ‘low’ to ‘high.’

Many Stocktwits users were seen as hopeful of the company’s positive guidance for the next quarter.

“We are confident in the long-term growth of our optimized LungFit PH system and have received positive feedback from new and existing customers as they realize the clinical benefits the system provides by offering on-demand, ambient air-generated NO compared to legacy cylinder NO systems,” Steve Lisi, Chairman and CEO Beyond Air, said in August.

In October, Beyond Air entered a strategic partnership with Healthcare Links, a renowned healthcare advisory and contracting firm, to expand access to Beyond Air's LungFit PH system by streamlining entry into Group Purchasing Organizations, or GPOs, and Integrated Delivery Networks, IDNs, across the US, The Fly reported.

XAIR stock is down 73.93% year-to-date, but Stocktwits sentiment suggests retail remains optimistic about the company’s long-term turnaround potential.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_hassett_resized_jpg_84f224d945.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019637_jpg_df5ef84d95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2164981884_jpg_df1cf8a926.webp)