Advertisement|Remove ads.

Beyond Air Stock Slides After Q2 Earnings Beat, Retail’s Confident

Medical device company Beyond Air ($XAIR) stock was down 9.8% on Tuesday morning (9:49 a.m. ET) after the company’s second-quarter revenues fell short of analyst estimates, pushing retail sentiment down.

The biopharma company’s earnings per share (EPS) were in line with analyst estimates of -$0.28.

However, its revenue came in at $798,000, falling short of consensus estimates of about $1.08 million. Net loss narrowed to $14.3 million compared to $17.4 million in the same period last year.

“Our commercial strategy continued to drive results throughout the quarter with our total number of customers increasing by over 60%,” Steve Lisi, CEO of Beyond Air, said in a statement. “We believe this is just the beginning of a pivotal year for our company as we leverage our expanding network of reference customers that have implemented LungFit PH in their hospitals.”

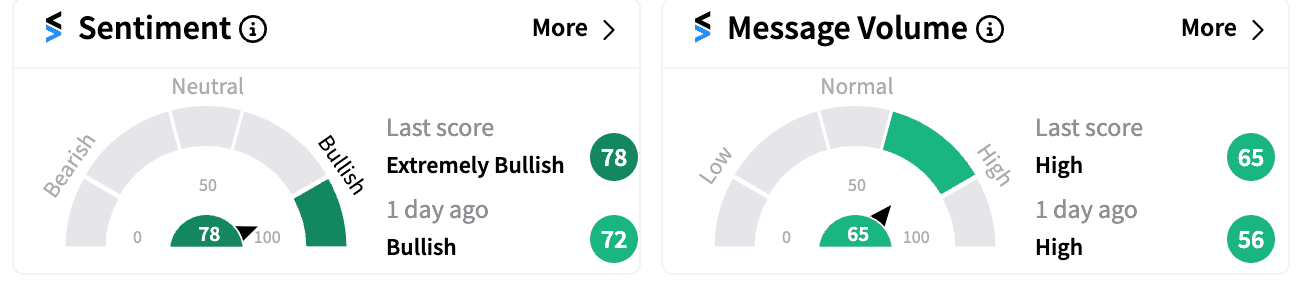

Retail sentiment on the stock turned ‘extremely bullish’ from ‘bullish’ a day ago. The accompanying message volumes were in the ‘high’ zone on Tuesday.

Beyond Air, which is focused on developing treatments for lung diseases, has also completed a $20.6 million private placement offering with “multiple healthcare-focused institutional funds” and company insiders, according to its regulatory filing with the Securities and Exchange Commission (SEC).

In addition, it has also retired $17.5 million in debt from Avenue Capital and has entered into a $11.5 million loan agreement with an insider-led investor group.

In 2021, Beyond Air reorganized its oncology business into a new private company called Beyond Cancer. Beyond Air’s preclinical oncology team and exclusive rights to the intellectual property portfolio for the treatment of solid tumors are currently with Beyond Cancer.

Beyond Air has 80% ownership in Beyond Cancer.

Beyond Air’s stock is down 77.2% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_hassett_resized_jpg_84f224d945.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019637_jpg_df5ef84d95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2164981884_jpg_df1cf8a926.webp)