Advertisement|Remove ads.

Xerox Stock Slips Premarket After Mixed Q4 Results But Retail Mood Brightens

Xerox Corp. (XRX), which sells print and digital document products, and services globally, reported Tuesday ahead of the market open mixed quarterly results but retail remains optimistic.

The Norwalk, Connecticut-based company reported fiscal 2024 fourth-quarter adjusted earnings per share (EPS) of $0.36, down from last year’s $0.43 and missing the consensus estimate of $0.53, as seen on Koyfin.

Revenue fell 8.6% year-over-year (YoY) to $1.61 billion versus the $1.58 billion consensus estimate. Print and other revenue fell 8.7% to $1.54 billion and Xerox Financial Services (XFS) revenue declined 11% to $89 million.

Xerox’s bottom line and topline trailed expectations in the past four quarters.

Fourth-quarter adjusted operating margin climbed 100 basis points (bps) to 6.4%, and operating cash flow fell $182 million YoY to $467million.

CEO Steve Bandrowczak said, “2024 was a critical year as we implemented a new operating model and structural process improvements to position Xerox for long-term, sustainable growth.’’

Looking ahead, the company expects low-single-digit revenue growth in constant currency for fiscal year 2025 and free cash flow of $350 million to $400 million. Analysts, on average, expect reported revenue of $6.36 billion, marking a 2.25% YoY increase.

Bandrowczak said, “We continue to see steady progress in our Reinvention, reflecting the resilience of our team and initiatives taken to-date.”

“In 2025, we expect to build on changes made in 2024 in order to focus on executing our Reinvention strategy, realizing the benefits of the ITsavvy and pending Lexmark acquisitions, and strengthening our balance sheet.’’

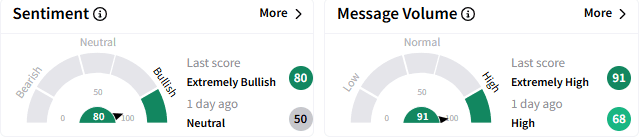

On Stocktwits, sentiment toward Xerox stock turned to ‘extremely bullish’ (80/100) from the ‘neutral’ (50/100) mood that prevailed a day ago. Retail chatter perked up amid the earnings release with the message volume hitting ‘extremely high’ levels.

Xerox shares fell 3.60% to $9.36 in premarket trading. The stock has gained over 15% in January after declining over 42% in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: SoundHound AI Stock Sinks On Plan To Raise $500M Through Securities Offerings: Retail Stays Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)