Advertisement|Remove ads.

Xiaomi Reports Record Revenue, Profit In Q1 Led By Smartphone, EV Sales: Retail Stays Optimistic

Chinese tech company Xiaomi Corporation (XIACF) reported a surge in revenue and profit to record levels in the first quarter of 2025, driven by its smartphone and electric vehicle (EV) segments.

Total revenue for the first quarter of 2025 reached a record high of RMB111.3 billion ($15.45 billion), representing an increase of 47.4% year-over-year (YoY), and beating an analyst estimate of RMB109.06 billion, as per Finchat data.

Xiaomi’s adjusted net profit in Q1 jumped 64.5% YoY to hit a record high of RMB10.7 billion.

The company’s smartphone and Artificial Intelligence of Things (AIoT) segment reported a 23% YoY surge in revenue to RMB92.7 billion.

Its global smartphone shipments rose 3% YoY to 41.8 million units, marking the 7th consecutive quarter of growth.

Revenue from its smart EV, AI, and other new initiatives segment reached RMB18.6 billion, including RMB18.1 billion from smart EV and RMB0.5 billion from other related businesses. Loss from operations related to the segment in the three months through the end of March was RMB0.5 billion.

Xiaomi currently delivers only its SU7 sedan. The company delivered 75,869 units of the SU7 in the quarter.

It launched its new SUV named YU7 earlier this month. Deliveries of the SUV are slated to start in July, waging competition against Tesla Inc’s Model Y SUV in China.

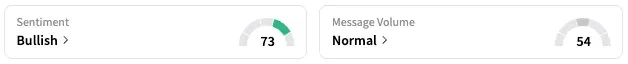

On Stocktwits, retail sentiment around XIACF stayed unmoved within ‘bullish’ territory over the past 24 hours while message volume stayed at ‘normal’ levels.

XIACF stock is up by over 56% this year and has tripled its value over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1 RMB = 0.14 USD

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1251437157_jpg_2ebb5f0c8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249830196_jpg_a4d60d5f3b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2225995334_jpg_67de820c56.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)