Advertisement|Remove ads.

Eli Lilly To Acquire SiteOne Therapeutics For Up To $1B To Advance Pain Management Pipeline: But Retail’s Unconvinced

Eli Lilly and Company (LLY) said on Tuesday that it would acquire California-based private biotechnology company SiteOne Therapeutics, Inc. for up to $1 billion in cash.

The $1 billion is inclusive of an upfront payment and subsequent payments upon achievement of certain regulatory and commercial milestones, the company said.

Eli Lilly is best known for its weight-loss drugs Mounjaro and Zepbound.

The transaction will allow Lilly to expand its pain management pipeline with the addition of STC-004, a Phase 2-ready Nav1.8 inhibitor being studied for the treatment of pain.

Nav1.8 inhibitors are a class of drugs that block the function of the NaV1.8 sodium channel, a protein involved in transmitting pain signals.

Mark Mintun, Lilly group vice president, Neuroscience Research and Development, said that the company is eager to continue the development of STC-004 with the SiteOne team as part of its efforts to advance novel, addiction-free pain therapies. Effective non-opioid treatments for pain remain limited, he noted.

“Innovation in pain management is critical to address the unmet needs of millions of patients around the world," he added.

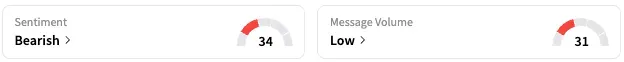

On Stocktwits, retail sentiment around Eli Lilly stayed unmoved in the ‘bearish’ territory over the past 24 hours while message volume remained at ‘low’ levels.

According to data from Koyfin, 22 of 28 analysts covering Eli Lilly rate it ‘Buy’ or higher, while five rate it a ‘Hold’ and one rates it a ‘Sell.’

The stock has an average price target of $955.31, representing about 30% upside to its current trading price.

LLY stock traded 1% higher on Tuesday morning. The stock is down by 7% this year and by over 10% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)