Advertisement|Remove ads.

Yelp Stock Rises As Investors Cheer Q4 Beat, Positive Guidance: Retail’s Unimpressed

Yelp, Inc. (YELP) stock climbed over 2% in Thursday’s extended trading after the B2C platform provider announced better-than-expected fiscal year 2024 fourth-quarter results and issued above-consensus guidance.

San Francisco, California-based Yelp reported fourth-quarter earnings per share (EPS) of $0.62, up from the $0.37 earned a year ago and beating the consensus estimate of $0.53.

Net revenue climbed 5.7% year over year (YoY) to $361.95 million versus the consensus estimate of $350.16 million and the guidance range of $347 million to $352 million.

Advertising revenue rose 6% to $346 million, or about 96% of the total. Services ad revenue increased about 11% to $224.84 million but restaurant, retail and other (RR&O) ad revenue fell about 3% to $120.80 million.

Yelp noted that adjusted earnings before interest, taxes, depreciation and amortization rose 5.2% YoY to $101.06 million, more than the $84 million to $89 million guidance, while adjusted EBITDA margin remained flat at 28%.

The company expects 2025 net revenue to be in the range of $1.470 billion to $1.485 billion and adjusted EBITDA to be in the range of $345 million to $360 million. Analysts, on average, estimate, revenue of $1.48 billion for the year.

It guided first-quarter net revenue in the range of $350 million to $355 million versus $347.75-million consensus estimate, and adjusted EBITDA of $65 million to $70 million.

The company expects Services to continue to drive its business performance in 2025 and RR&O to remain pressured.

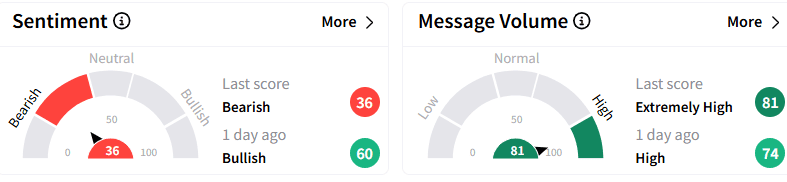

On Stocktwits, retail sentiment toward Yelp stock turned ‘bearish’ (36/100) from the bullish mood that prevailed a day ago. The message volume spiked to ‘extremely high’ as the retail discussed the company’s result.

Yelp stock ended Thursday’s after-hours session up 2.34% to $41.50. The stock is up about 5% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com

Read Next: Roku Stock Rallies To Highest In A Year After Q4 Beat: Retail Braces For 2021-Like Euphoria

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247675651_jpg_f78879cce2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263890310_jpg_1f5b1fba80.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)