Advertisement|Remove ads.

Roku Stock Rallies To Highest In A Year After Q4 Beat: Retail Braces For 2021-Like Euphoria

Roku, Inc. (ROKU) shares rallied sharply in Thursday’s after-hours session as investors reacted to the streaming device maker’s fiscal year 2024 fourth-quarter results that topped expectations.

The San Jose, California-based company reported a fourth-quarter loss per share of $0.24, narrower than the year-ago loss of $0.55 and the consensus loss estimate of $0.41

Revenue climbed 22% year-over-year (YoY) to $1.2 billion, exceeding the consensus estimate of $1.15 billion and the guidance of $1.14 billion.

Platform revenue rose 25% to $1.04 billion and devices revenue was up 7% to $165.7 million.

Gross margin contracted by 1.8 points to 42.7%, while adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin expanded by 1.6 points to 6.5%. The adjusted EBITDA climbed YoY to $77.5 million from $47.7 million, beating the $30 million guidance.

Among user metrics, streaming households climbed 12% YoY to 89.8 million at the end of the fourth quarter, and streaming hours increased 18% to 34.1 billion hours. The growth decreased slightly from 13% and 20%, respectively, in the third quarter. The trailing twelve-month average revenue per user edged up 7% to $41.49 after remaining flat in the previous quarter.

The fourth-quarter net subscriber additions were 4.3 million.

The company noted that streaming households surpassed 90 million in the first week of January.

Roku expects first-quarter net revenue of $1.005 billion, with platform revenue likely growing 16% and devices revenue remaining flat. This is in line with the consensus estimate of $1.01 billion.

It guided quarterly adjusted EBITDA to $55 million.

The company’s full-year guidance calls for net revenue of $4.610 billion and adjusted EBITDA of $350 million. According to Yahoo Finance, the consensus revenue estimate for the year is $4.62 billion.

Roku expects to be operating income-positive for the full year 2026.

CEO Anthony Wood said, “We are maintaining our focus on operational discipline, while continuing to invest in Platform growth.”

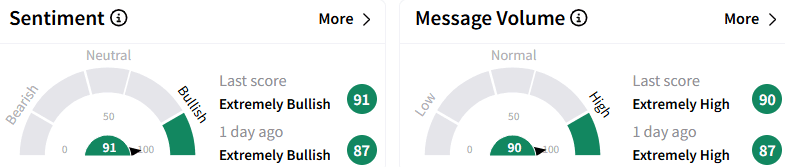

On Stocktwits, sentiment toward Roku stock remained ‘extremely bullish’ (91/100), with the message volume staying at an ‘extremely high’ level. The stock was among the top five trending tickers on the platform late Thursday.

A retail trader braced for a ‘2021-like euphoria’ when Roku surged on its credentials as a COVID-19 play, topping at $490+ in late July 2021.

Another user braced for incremental gains coming from a short squeeze. According to Yahoo Finance, about 8.31 million shares were shorted at the end of January.

Roku stock ended Thursday’s premarket session up 11% at $96.35, marking the highest level since Feb. 12, 2024. The stock has gained about 17% so far this year after declining by 19% in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870269_jpg_b38339787f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)