Advertisement|Remove ads.

Yes Bank Surges On SMBC Deal: SEBI RA Orchid Research Predicts Rally To ₹25

Yes Bank shares surged nearly 9% on Monday after Japan’s Sumitomo Mitsui Banking Corporation (SMBC) announced it would acquire a 20% stake in the private lender for ₹13,483 crore ($1.58 billion).

As part of the deal, SMBC will acquire a 13.19% stake from State Bank of India (SBI)—Yes Bank’s largest shareholder—and an additional 6.81% from a consortium of Indian banks including HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, IDFC First Bank, Federal Bank, and Bandhan Bank.

The deal is subject to regulatory approvals from the Reserve Bank of India (RBI), the Competition Commission of India (CCI), and Yes Bank’s shareholders. Once completed, SMBC will gain the right to nominate two directors to Yes Bank’s board.

SEBI-registered advisor Orchid Research flagged a breakout pattern in Yes Bank’s chart on Friday, citing heavy momentum, a strong Average Directional Index (ADX), and supportive volumes.

They expect the stock to potentially rally up to ₹25, with a stop loss at ₹18.

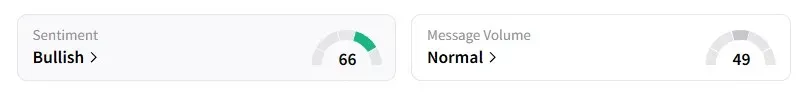

Meanwhile, data on Stocktwits shows that retail sentiment remains ‘bullish’ on the counter.

Yes Bank shares have gained 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)