Advertisement|Remove ads.

Zeekr Stock Soars After Parent Geely Proposes To Take It Private: Retail Stays Positive

NYSE-listed shares of EV maker ZEEKR Intelligent Technology Holding (ZK) jumped 11% on Wednesday morning after its parent and Chinese carmaker Geely proposed taking it private.

In a filing with the Hong Kong stock exchange, Geely said that it has submitted a non-binding proposal to Zeekr, indicating its interest in taking the EV maker private by acquiring all issued and outstanding Zeekr shares and American Depositary Shares (ADSs).

The company proposed to value Zeekr at $25.66 per ADS, which represents a premium of approximately 13.6% to the stock’s closing price on the NYSE on Tuesday.

Geely holds approximately 65.7% of the total issued and outstanding share capital of ZEEKR as of May 7.

If the proposed privatisation goes through, Zeekr would become a wholly owned subsidiary of the company and would be delisted from the NYSE, the company said.

Geely believes the integration of Zeekr’s assets and resources will help enhance the competitiveness of its passenger vehicle business.

“As ZEEKR is a global premium electric mobility technology brand targeting the high-end premium market, taking full equity control over ZEEKR is strategically significant for the Group,” it said.

Zeekr went public in the U.S. in May 2024. Last month, Zeekr Group delivered a total of 41,316 vehicles across its Zeekr and Lynk & Co brands, marking a 1.5% increase compared to March.

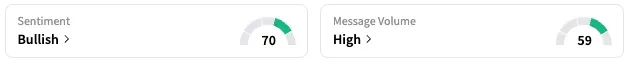

On Stocktwits, retail sentiment around Zeekr stayed unmoved within the ‘bullish’ territory over the past 24 hours while its message volume jumped from ‘normal’ to ‘high’ levels.

ZK stock is down by 8% this year and 12% over the past 12 months.

Also See: Novo Nordisk Stock Rises Pre-Market On Q1 Beat Despite Lowering Outlook – Retail’s Elated

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)