Advertisement|Remove ads.

Zions Bancorp Stock Rises On Q3 Earnings Beat: Retail Sentiment Brightens

Zions Bancorporation’s ($ZION) shares traded 4.5% higher on Tuesday morning as of 9:38 am ET following better-than-expected third-quarter earnings, lifting retail sentiment.

Zions earnings per share (EPS) came in at $1.37 about 16.48% above the expected price by analysts. The firm reported revenues of $792 million, beating analyst expectations by 1.76%.

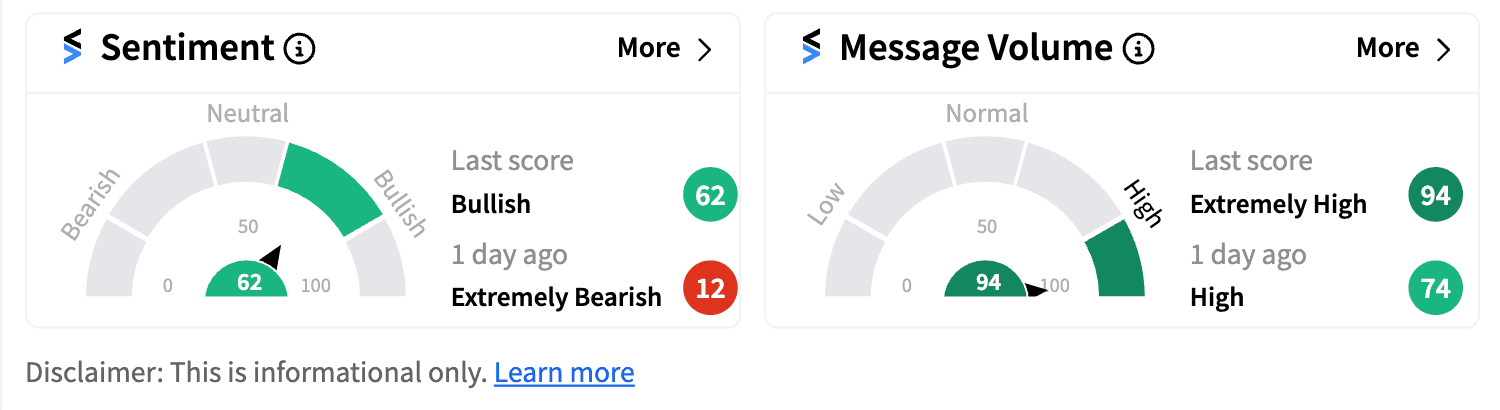

Retail sentiment on the stock turned ‘bullish’ (62/100) on Tuesday from ‘extremely bearish’ a day ago. Message volumes were in the ‘extremely high’ zone.

“We're pleased with the continued improvement in our financial performance, reflected in the 21% increase in earnings per share over the same period last year. The net interest margin strengthened to 3.03% from 2.93% a year ago, and operating costs increased a modest 1%,” Harris H. Simmons, Chairman and CEO of Zions, said in a statement.

Morgan Stanley analyst Manan Gosalia has increased the firm's price target from $54 to $56 following the news while keeping an Equal Weight rating on its stock. Gosalia is reportedly raising the brokerage's 2025 EPS estimate by 2% on higher net interest income and lower expenses.

Meanwhile, Barclays also raised the firm's price target to $52 from $47 but kept an ‘Underweight’ rating. The firm cited increased net interest income, provision, fees, expenses compared to consensus estimates.

Zions reported about $87 billion of total assets as of December 31, 2023, and posted annual net revenues of $3.1 billion in 2023.

The bank also announced it has struck a deal with FirstBank to buy four of its branches in California's Coachella Valley for an undisclosed sum. The branches in question have about $730 million in deposits and $420 million in loans.

ZION stock is up 12% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2087343447_jpg_13cd4f17f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_f7a640a687.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Netflix_resized_18d5e3153e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corvus_pharma_jpg_566ccd14de.webp)