Advertisement|Remove ads.

Zions Bancorp Stock Lower Ahead Of Q3 Earnings: Retail Sentiment Negative

Zions Bancorporation’s ($ZION) shares traded 2% lower on Monday afternoon ahead of its third quarter earnings, with retail sentiment pessimistic.

Zions is expected to post $1.18 in earnings per share (EPS) on revenue of $778.3 million estimated by analysts. The bank’s earnings are due after markets close.

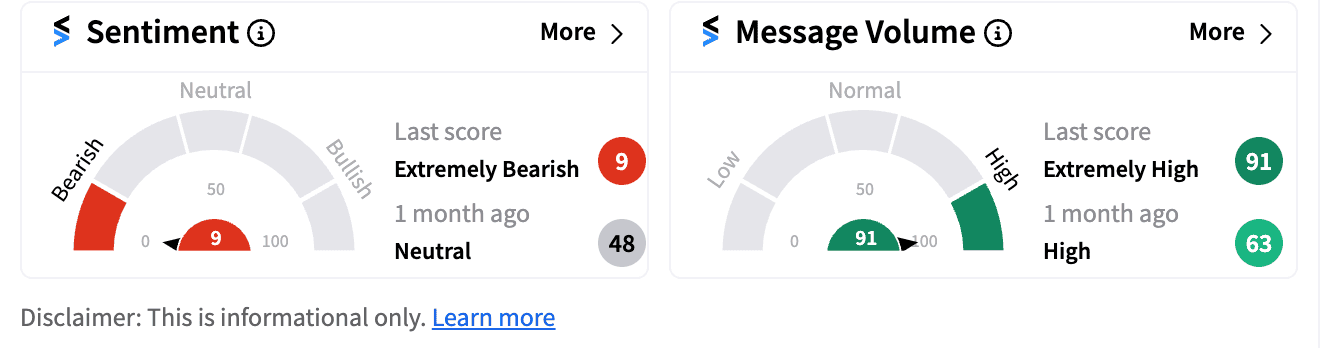

Retail sentiment on the stock was ‘extremely bearish’ on Monday with message volumes ‘extremely high.’

For its second quarter, the regional bank posted EPS of $1.28, beating estimates by 17.01%.

The bank’s second quarter results reflected continued improvement in its net interest margin, effective expense management, and strengthened capital position, Harris H. Simmons, Chairman and CEO of Zions said at the time. He highlighted the lender’s tangible book value per share had increased by 20% over the year-ago period.

Its pre-earnings options volume was reported at 1.5x normal, the fly reported.

Zions reported about $87 billion of total assets as of December 31, 2023, and posted annual net revenues of $3.1 billion in 2023.

The stock is up 13.29% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2087343447_jpg_13cd4f17f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_f7a640a687.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Netflix_resized_18d5e3153e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_corvus_pharma_jpg_566ccd14de.webp)