Advertisement|Remove ads.

Zoom Stock Soars Almost 11% — What’s The 'Hidden Gem' That Baird Sees?

- As per analyst William V. Power of Baird, Zoom’s $51 million investment in Anthropic could now be worth between $2 billion and $4 billion, assuming Anthropic’s rumored current valuation of about $350 billion.

- According to a report from the Wall Street Journal earlier this month, Anthropic is planning to raise about $10 billion at a valuation of $350 billion.

- Baird maintained an ‘Outperform’ rating on Zoom’s shares with a price target of $95.

Shares of Zoom Video Communications Inc. (ZM) soared nearly 11% on Monday, reaching a 52-week high of $94.83 in mid-day trade and the highest price it has been since closing at $97.44 on Aug. 22, 2022, according to data from Yahoo Finance.

According to analyst Baird Equity Research, the market has been focused mostly on the video-call company’s ability to reaccelerate revenue growth and capture AI opportunities gradually.

However, "the quieter, hidden gem" for Zoom is likely its $51 million investment in Claude-maker Anthropic in 2023, the analyst told investors in a note, according to TheFly.

In May 2023, Zoom made an investment in Anthropic and also partnered with the company to use Claude to build customer-facing AI products.

Analyst Rationale

As per William V. Power of Baird, Zoom’s $51 million investment in Anthropic, that was valued at about $4.5 billion at the time, could now be worth between $2 billion and $4 billion, assuming Anthropic’s rumored current valuation of about $350 billion.

According to a report from the Wall Street Journal earlier this month, Anthropic is planning to raise about $10 billion at a valuation of $350 billion. The funding will follow a $13 billion investment in Sept. 2025 that valued the company at $183 billion at the time.

"ZM is literally invested in Anthropic’s Claude success, and as Anthropic IPO rumors accelerate, the investment could become even more meaningful," Baird’s Power said in a research note, according to Investing.com.

According to the analyst, Zoom reported $406.1 million as gains on strategic investments in the third-quarter (Q3), which Baird says was largely a result of its Anthropic investment. This improved the company’s GAAP earnings per share (EPS) by $1.33 in the quarter.

Baird maintained an ‘Outperform’ rating on Zoom’s shares with a price target of $95, the current level at which the stock is trading.

How Did Stocktwits Users React?

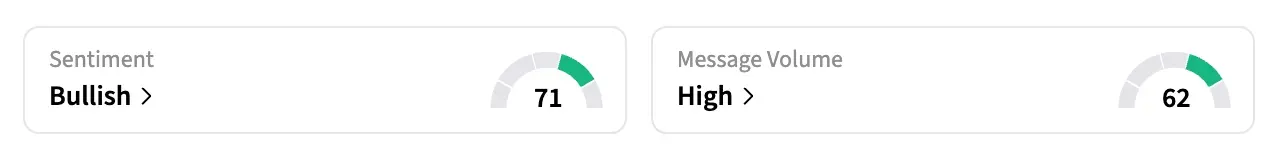

On Stocktwits, retail sentiment around ZM shares jumped to ‘bullish’ from ‘neutral’ territory in the past 24 hours, and message volumes increased to ‘high’ from ‘normal’ levels.

One bullish user noted that video conferencing has become popular on TV as well as in the corporate world, adding that ‘this is an easy call’ for them.

Shares of ZM have risen over 16% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_applied_optoelectronics_wafer_production_resized_759caf364b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_duolingo_resized_jpg_b62f52b726.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_purple_jpg_faad1be151.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259270325_jpg_4fbb248789.webp)