Advertisement|Remove ads.

Zoom Video Stock Headed Toward One-Month Low As Lackluster Guidance Takes Sheen Off Q4 Beat: Retail Mood Mixed

Zoom Video Communications, Inc. (ZM) shares pulled back sharply in Tuesday’s premarket trading after the video conferencing app provider announced fiscal year 2025 fourth-quarter results that exceeded expectations. However, key user metrics remained soft, and the forward guidance was lackluster.

The San Jose, California-based company reported fourth-quarter (Q4) adjusted earnings per share (EPS) of $1.41, compared to $1.42 a year ago and the consensus of $1.30. The bottom line also bettered the guidance range of $1.29-$1.30.

Revenue climbed 3.3% year over year (YoY) to $1.18 billion, above the $1.17 billion consensus and in line with the $1.175 billion to $1.180 billion guidance.

The nearly 6% growth in enterprise revenue ($706.8 million) helped offset the 0.4% drop in online revenue.

Zoom founder and CEO Eric Yuan said, “In FY25, Zoom [artificial intelligence] AI Companion emerged as the driving force behind our transformation into an AI-first company, enabling our customers to discover enhanced productivity opportunities.”

He noted that the annual reported operating margin expanded by a robust 5.8 points, thanks to the focus on prioritizing investments and controlling share-based compensation.

Operating cash flow for the year climbed nearly 22% to $2 billion, translating to an operating cash flow margin of 41.7%.

Among user metrics, Zoom Video ended the quarter with 192,600 enterprise customers, up slightly from 192,400 in the previous quarter. The trailing 12-month net dollar expansion rate for enterprise customers was steady at 98% versus the third quarter.

The number of customers contributing revenue of more than $100,000 in the trailing 12 months was 4,088, up from 3,995 in the third quarter.

The online average monthly churn fell 20 basis points YoY to 2.8%.

Zoom Video expects first-quarter adjusted EPS of $1.29 to $1.31 and revenue of $1.162 billion to $1.167 billion. Analysts, on average, expect earnings of $1.31 on a revenue of $1.17 billion.

The company has projected fiscal year 2026 adjusted EPS of $5.34 to $5.37 and a revenue of $4.785 billion to $4.795 billion. These trailed the consensus estimates of $5.39 and $4.81 billion, respectively.

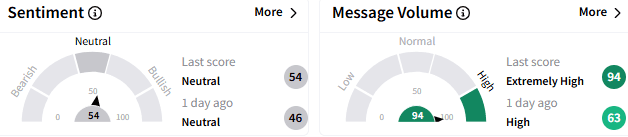

Retail sentiment on Stocktwits stayed ‘neutral’ (54/100), but the message volume perked to ‘extremely high’ levels amid the earnings announcement.

A bullish user said the soft guidance was a strategy.

Another user said the daily price chart did not evince much confidence.

In premarket trading, Zoom Video stock fell 3.82% to $78, headed toward a one-month low. The stock has lost nearly a percent for the year.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)