Advertisement|Remove ads.

Apple Analyst Says Cupertino’s $500B US Investment To Play Well Into Trump’s ‘Make In America’ Theme: Retail Sentiment Lags

Apple, Inc. (AAPL) was the only Magnificent Seven stock that advanced on Monday, with the resilient performance fueled by the company's announcement regarding a $500 billion investment in the U.S. over the next four years.

Commenting on the plan, Apple bull and tech analyst Daniel Ives said it was a strategic move to diversify manufacturing away from China while also fitting into President Donald Trump’s U.S. investment theme.

The announcement came after Apple CEO Tim Cook met with Trump in the Oval Office last week. After the meeting, the president said at a meeting of governors that Cook “stopped two plants in Mexico,” shifting production to the U.S., Bloomberg reported.

“They don’t want to be in tariffs,” Trump added.

The president has confirmed that the additional tariffs his administration has proposed on imports will go into effect next month after a month-long delay in their implementation.

Ives said, “Cook continues to prove that he is 10% politician and 90% CEO and times like this he will be using his strong ties globally to make sure it’s smoother waters for Cupertino.”

The analyst does not believe the investment is a signal that Apple is tweaking its China manufacturing buildout, reasoning that the newly announced domestic investments are not areas the company focuses on for its China region.

Among the initiatives under the investment plan are:

- Opening a new advanced manufacturing facility in Houston to produce servers that support Apple Intelligence

- Doubling of its U.S. Advanced Manufacturing Fund to $10 billion.

- Creating an academy in Michigan to train the next generation of U.S. manufacturers

- Growing R&D investments in the U.S. to support cutting-edge fields like silicon engineering

Apple said the $500 billion commitment included work with thousands of suppliers across all 50 states, direct employment, Apple Intelligence infrastructure and data centers, corporate facilities, and Apple TV+ production in 20 states.

Ives has an ‘Outperform’ rating and a $325 price target for Apple stock.

Deepwater Asset Management Managing Partner Gene Munster said Apple is poised to increase its annual U.S. expenditure by 45% to $39 billion. He sees the announcement as evidence that the company realizes that an artificial intelligence (AI)-powered future will require more infrastructure investments.

Of the $19 billion incremental annual U.S. spending the venture capitalist forecasts, 15% will go to the new hires, numbering 20,000.

Munster said Apple is looking to avoid tariffs and channeling those “savings” into U.S. investments, with tariff avoidance paying for 50% of the incremental spending.

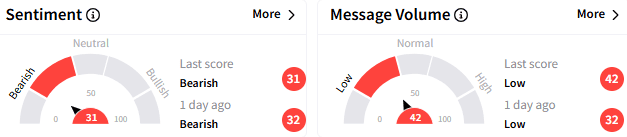

On Stocktwits, retail sentiment toward Apple stock stayed ‘bearish’ (31/100), with the subdued mood accompanied by ‘low’ message volume.

In premarket trading, Apple stock fell 0.28% to $246.50. The stock has lost about 1.5% since the start of the year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)