Advertisement|Remove ads.

ZScaler Stock Tanks, So Does Retail Sentiment On Dim Earnings Outlook

Shares of cybersecurity provider Zscaler Inc. (ZS) tumbled more than 16% on Wednesday following a disappointing earnings forecast.

The company’s weak guidance has also led to a sharp decline in retail sentiment, which has fallen to extremely bearish levels.

Zscaler’s management, after market hours on Tuesday, reportedly revealed that macroeconomic challenges have affected billings from three-year contracts, resulting in a lowered growth expectation for the first half of fiscal 2025.

The company now projects full-year revenue between $2.60 billion and $2.62 billion, falling short of analysts’ estimate of $2.63 billion.

Additionally, Zscaler forecasted full-year adjusted net income of $2.81 to $2.87 per share, compared to the anticipated $3.33.

The company’s forecast for earnings per share of $0.62 to $0.63 also missed analyst expectations. This guidance led at least 14 brokerages to lower their price targets on the stock.

Notably, Needham reduced its target the most, cutting it by $65 to $235, although it maintained a ‘Strong Buy’ rating. Needham’s research highlighted that Zscaler’s initial fiscal 2025 billings guidance was more “in line and more back-half weighted” than expected, contributing to the stock’s recent struggles.

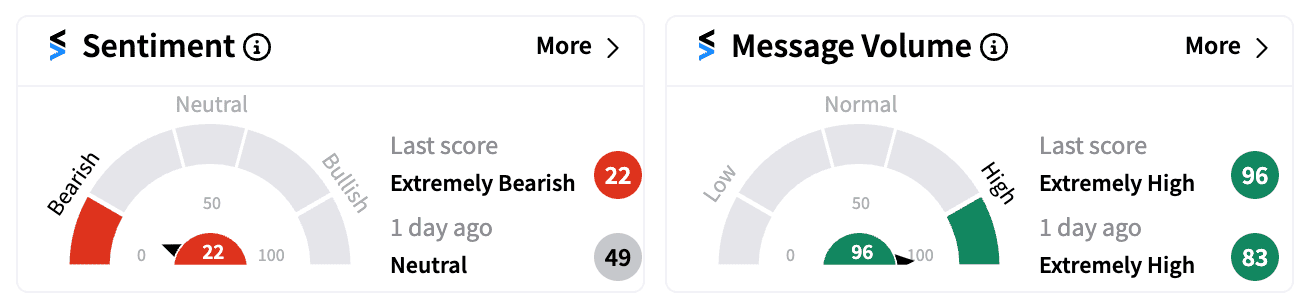

On Stocktwits, retail sentiment for Zscaler has plummeted to an ‘extremely bearish’ score (22/100), with message volume reaching ‘extremely high’ levels.

Pessimistic users are anticipating further downgrades and sell-offs, reflecting the overall negative mood surrounding the stock.

Despite the immediate fallout, some analysts, including Needham, view the current dip as a potential buying opportunity for long-term investors.

Year-to-date, Zscaler’s stock has dropped over 24%, with some analysts concerned that the company may struggle to secure large, transformative deals consistently. This worry is heightened by the current macroeconomic conditions and the increasingly competitive SASE (Secure Access Service Edge) market.

Read Next: Nvidia Stock Slips Further On Report Of DOJ Subpoena Amid Antitrust Probe: Retail Turns Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)