Advertisement|Remove ads.

Zscaler Shares Rise As Analysts Lift Price Target Ahead Of Q3 Earnings: Retail Stays Bearish

Zscaler Inc. (ZS) shares traded 2.5% higher on Friday after Wall Street highlighted its bullish stance ahead of its earnings.

Stifel analyst Adam Borg increased the price target on Zscaler to $270 from $235 while maintaining a ‘Buy’ rating. The analyst anticipates an earnings beat based on positive mid- and late-quarter channel checks and past performance trends.

However, Borg expects the company to either reiterate or modestly raise its full-year 2025 outlook in line with the results.

Still, with the stock already seeing strong gains and short interest rising, Borg questioned whether that would be sufficient to drive the stock higher after the earnings.

Mizuho analyst Gregg Moskowitz raised the firm’s price target to $250 from $220 while maintaining a ‘Neutral’ rating.

Moskowitz noted that overall software industry checks were strong, despite some disruptions in April linked to tariff-related developments, which led to customer delays in sectors like retail and manufacturing.

Still, most channel partners performed well. In the research note to investors, the analyst stated that cybersecurity outperformed other software segments.

Zscaler helps organizations advance their digital transformation by enhancing security.

Its Zero Trust Exchange platform, built on a SASE framework and operating across over 150 global data centers, safeguards users, devices, and applications from cyber threats and data breaches.

For its second quarter (Q2), the company reported a 23% jump in revenue to $647.9 million, beating the consensus estimate of $635.35 million, per Finchat data.

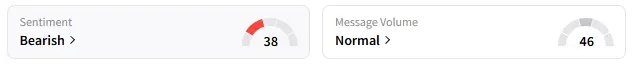

On Stocktwits, retail sentiment around Zscaler remained ‘bearish’.

Zscaler stock has gained over 39% in 2025 and 40% in the last 12 months.

Also See: Nvidia Eyes Shanghai R&D Center Amid US Export Pressure, Says Report: Retail Remains Buoyant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)