Advertisement|Remove ads.

Investors Eye Zscaler’s Q2 Results After Rival Crowdstrike’s Mixed Print: Retail Stays Bullish

Zscaler, Inc. (ZS) stock remained volatile on Wednesday as the cybersecurity vendor prepares to release its quarterly results after the closing bell.

According to the Finchat-compiled consensus estimates, the San Jose, California-based company is expected to report adjusted earnings per share (EPS) of $0.69 and revenue of $635.35 million for the second quarter of the fiscal year 2025.

This compares to the year-ago EPS of $0.76 and revenue of $525 million, with the 21% estimated year-over-year (YoY) topline growth marking a deceleration from 26% in the first quarter.

The guidance issued in early December calls for $0.68 to $0.69 in EPS on revenue of $633 million to $635 million.

Shares of larger peer Crowdstrike, Inc. (CRWD) plunged nearly 8% on Wednesday despite a quarterly beat. The market did not take kindly to a slowdown in key operational metrics and its mixed guidance.

Zscaler investors will also likely focus on key operating metrics such as deferred revenue and calculated billings, which grew at a 27% and 13% YoY, respectively.

Investors may also be keen to know whether the company tinkers with its fiscal year 2025 guidance, which models EPS of $2.94 to $2.99 and revenue of $2.623 billion to $2.643 billion.

Earlier this month, Barclays raised the price target for Zscaler stock to $250 from $220 and maintained an ‘Overweight’ rating. The firm braced for a $5 million to $10 million upside to estimates but sees slower scheduled billings as a pushback.

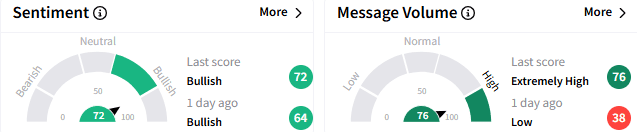

On Stocktwits, the retail sentiment toward Zscaler stock remained 'bullish' (72/100) and retail chatter picked up to ‘high’ levels.

Ahead of the results, a bullish watcher said they look forward to an earnings beat and the stock rising over $205.

Zscaler shares traded up 0.45% at $194.69 by Wednesday afternoon. The stock has gained about 7.5% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Google-Parent Alphabet Reportedly Lobbies Against Breakup Of Company: Retail Unmoved

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219715394_jpg_c787a7b591.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_martin_shkreli_jpg_4da92d4843.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)