Advertisement|Remove ads.

Darden Restaurants Stock Rises Pre-market Despite Weaker-Than-Expected Q1 Report: Retail’s Surprised

Darden Restaurants (DRI) on Thursday announced weaker-than-expected first-quarter results, with revenue and earnings falling short of Wall Street estimates. However, shares of the firm were trading over 7% higher in Thursday’s pre-market session as of 8:16 a.m. ET.

Revenue rose 1% year-over-year (YoY) to $2.76 billion versus an estimate of $2.8 billion while earnings per share stood at $1.75 compared to an estimate of $1.83.

From a segmental point of view, Olive Garden sales declined 1.5% YoY to $1.209 billion while LongHorn Steakhouse sales rose 6.5% to $713.50 million. Fine Dining sales rose nearly 2% YoY to $278.9 million.

Darden CFO Raj Vennam said the significant step down in traffic during July, led to the firm’s first quarter earnings being lower than expected. “Following the softness in July, our sales trend has continued to improve. Considering this recovery as well as the planned initiatives to support the remainder of the fiscal year, we are reiterating our guidance for fiscal 2025,” he said.

The firm expects diluted net earnings per share from continuing operations of $9.40 to $9.60, which does not include any impact from Chuy's operations, transaction, financing and integration related costs associated with the pending acquisition.

Meanwhile, Darden’s board of directors declared a quarterly cash dividend of $1.40 per share, payable on Nov. 1, 2024 to shareholders of record at the close of business on Oct. 10, 2024.

During the quarter, the company repurchased nearly 1.2 million shares for a total of $172 million. As of the end of the fiscal first quarter, the firm had $743 million remaining under its current $1 billion repurchase authorization.

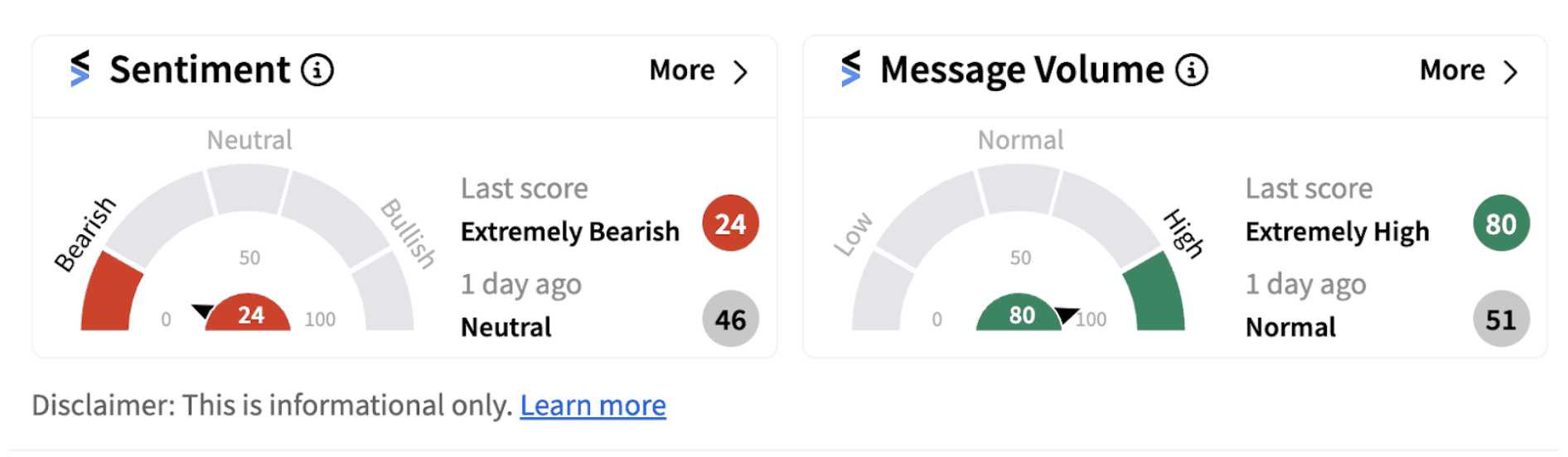

Although Wall Street appeared to be pleased with the firm’s Q1 earnings, retail investors were disappointed, with the sentiment meter dipping into the ‘bearish’ territory (24/100) from the ‘neutral’ zone a day ago. The move was accompanied by ‘extremely high’ message volume (80/100).

Stocktwits users with a ‘bearish’ view are questioning the pre-market surge in the stock given the disappointing earnings.

Also See: Target Stock Rises After Former PepsiCo Exec Jim Lee Named New CFO: Retail’s Not Impressed Yet

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213582854_jpg_830e44a354.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943683_jpg_d01763122d.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/whatsapp-business-2025-07-be92a2c43157e61dd8748a769c6ab84b.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/07/tata-group-2025-07-65ccfee43b311b2001c68dd4eec5ebb4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1243243511_jpg_58a7a7cb8e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)