Advertisement|Remove ads.

HIMS Stock Slides After Eli Lilly’s Discounted Single-Dose Zepbound Offering: Retail Investors Unfazed

Shares of telehealth company Hims & Hers Health Inc. (HIMS) fell over 5% on Tuesday following news that Eli Lilly & Co. (LLY) is now selling single-dose vials of its popular weight-loss drug Zepbound at a steep discount.

Lilly’s Zepbound vials, priced at $399 per month, represent a 50% or greater discount compared to other incretin or GLP-1 medicines for obesity, as the company attempts to address ongoing supply shortages.

The move by Lilly is seen as a significant challenge to GLP-1 compounders, including Hims & Hers, which recently entered the weight-loss drug market.

Citi analyst Daniel Grosslight described Lilly’s pricing strategy as a "shot across the bow" for compounders, emphasizing the company's efforts to protect patients from counterfeit or unsafe knock-off versions of the drug.

Despite the potential threat from Lilly, analysts remain cautiously optimistic about Hims & Hers' prospects. Needham, which recently initiated coverage of HIMS with a ‘Buy’ rating and a $24 price target, acknowledged the increased volatility associated with the company’s GLP-1 offerings but believes that the impact will ultimately be more positive than negative.

Needham said Hims & Hers continues to grow at over 40% annually, even without significant contributions from GLP-1 drugs, boasting over $1 billion in revenue with multiple growth opportunities.

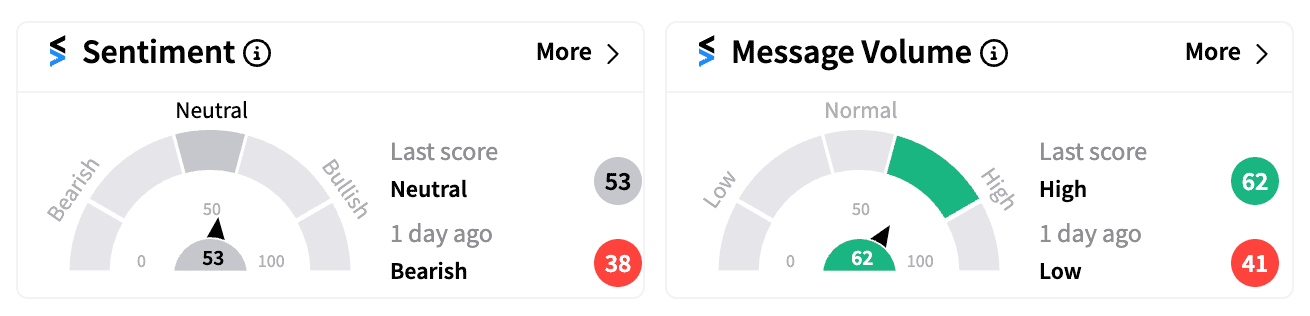

On Stocktwits, retail sentiment for HIMS shifted from ‘bearish’ to ‘neutral’ (53/100), with several watchers expressing confidence in the company's long-term growth potential beyond the GLP-1 segment.

One user pointed out that GLP-1 drugs represent less than 10% of Hims & Hers’ entire drug portfolio, highlighting the company’s diversified product mix.

Earlier this month, Hims revealed it was set to buy a U.S.-based compounding pharmacy for approximately $31 million, in line with its strategy of offering copycat versions of popular weight-loss drugs, including those from Novo Nordisk (NVO).

Despite the challenges posed by larger competitors like Lilly, Hims & Hers’ strong Q2 performance, which exceeded Wall Street expectations, showed the beat was driven by surging demand for its weight-loss medicines.

The company also raised its 2024 sales forecast to a range of $1.37 billion to $1.40 billion (from an earlier guidance of $1.20 billion to $1.23 billion), signaling confidence in its continued growth and market presence.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)