Advertisement|Remove ads.

Micron Earnings: Citi Says 80% Of Investors Bearish Ahead Of Q4 Report, Retail Echoes Skepticism

As Micron Technology (MU) approaches its Q4 earnings report on Wednesday, Sept. 25, investor sentiment is overwhelmingly negative, according to a Wall Street brokerage.

Citi, after speaking with numerous hedge funds and mutual funds, estimates that roughly 80% of investors are bearish on the stock going into the earnings release. While hedge funds expressed uniform skepticism, a few mutual funds remain optimistic.

Citi’s revised estimates project $8 billion in revenue and $1.24 in earnings per share for the November quarter, reflecting mid-single-digit growth quarter-over-quarter. This is slightly below the consensus estimates of $8.3 billion in revenue and $1.30 in earnings per share.

Still, Citi maintained its ‘Buy’ rating on Micron, albeit with a reduced price target of $150, down from $175.

Micron — the largest U.S. manufacturer of computer memory chips — plays a critical role in AI hardware through its high-bandwidth memory (HBM), which partners with Nvidia processors to accelerate data processing for AI models.

However, many analysts reportedly argue that the AI-related surge in demand may be overhyped, especially given the company’s underwhelming forecast in June.

While Micron is benefiting from AI-driven demand, its core markets — personal computers and smartphones — are still struggling. The June-quarter forecast of $7.6 billion in revenue disappointed investors who had anticipated stronger growth from the AI boom.

Several analysts have recently cut their price targets on Micron, citing weakness in its legacy DRAM business.

Citi’s Christopher Danely lowered the firm’s price target to $150 ahead of the Q4 report, citing DRAM oversupply issues, but he remains optimistic that these challenges will subside by year-end.

BNP Paribas Exane took a more bearish stance earlier this month, warning that Micron’s stock could continue to underperform, especially compared to other AI-related companies.

The brokerage highlighted concerns over capacity oversupply in HBM chips, which could lead to a quicker-than-expected market correction for DRAM prices.

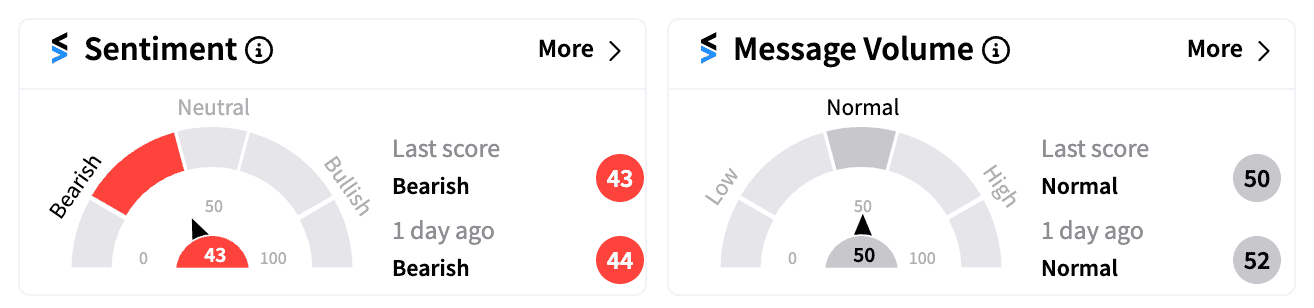

On Stocktwits, retail sentiment among Micron’s 154,000 followers remained firmly ‘bearish’ early Monday, mirroring the broader skepticism from institutional investors.

Micron’s stock is up just over 10% year-to-date, trailing behind other semiconductor peers like AMD (up 12%) and Qualcomm (up 20%).

As the company navigates its Q4 earnings report and looks to overcome challenges in its core markets, investors remain cautious about whether the AI boost can outweigh ongoing headwinds.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)