Advertisement|Remove ads.

As Wall Street Bleeds, Here’s Why Retail Is Bullish On Pringles-Maker Kellanova

In October 2023, Kellogg Company completed the separation of its North American cereal business through a tax-free spin-off of WK Kellogg Co to Kellogg Company shareholders. Following the separation, Kellogg Company changed its name to Kellanova.

Today, the Pringles-maker (Kellanova) saw shares jump 20% at market opening on Monday after a Reuters report indicated a potential bid is in the works. According to the report, Snickers-maker Mars is looking to acquire the firm in what would be one of the largest packaged foods deals ever given Kellanova’s enterprise value of nearly $28 billion.

The report, however, also stated that there is also the possibility that Kellanova may not pursue the deal with Mars or any other potential suitor. Even if the reports are true, what remains to be seen is whether anti-trust regulators are comfortable approving the deal given its size and potential impact on competition.

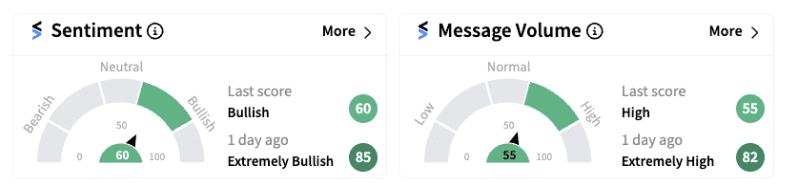

As a result, retail sentiment on Stocktwits has fallen one notch to the ‘bullish’ territory (60/100) from the ‘extremely bullish’ zone a day ago. Despite the downtick in sentiment, retail investors remain upbeat about Kellanova following its second-quarter earnings.

During the second quarter, Kellanova reported revenues of $3.19 billion versus an estimate of $3.15 billion. Earnings per share came in at $1 compared to an estimate of $0.90. Management also raised its full-year guidance.

Organic-basis net sales growth guidance was raised to 3.50% or better, from its previous guidance of approximately 3% or better. Adjusted-basis operating profit guidance range was raised to $1.88-1.90 billion, from previous guidance of $1.85-1.90 billion.

The firm expects adjusted-basis earnings per share at approximately $3.65-3.75, compared to an earlier guidance of approximately $3.55-3.65. Following the upbeat earnings, Bank of America reportedly upgraded Kellanova from ‘Neutral’ to ‘Buy’ while raising its price target from $62 to $70.

With investors awaiting confirmation of the deal news, they’ll be watching to find out whether the bid value leaves any upside. Moreover, regulator’s appetite for the deal size and the structure of the transaction are some of the key details that retail investors believe will make or break the deal.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitdeer_0adcf9a760.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254687746_jpg_9f8228b6ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cfpb_resized_png_ad08d8de38.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_52154609_jpg_bc5ad676b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_7ed87bb07c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)