Advertisement|Remove ads.

Microsoft, BlackRock Partner With Investors To Launch New AI Partnership With $100B Investment Potential: Retail Is Bullish

Microsoft (MSFT), in collaboration with global asset manager BlackRock (BLK), infrastructure investor Global Infrastructure Partners (GIP) and technology investment vehicle MGX, announced the launch of Global AI Infrastructure Investment Partnership (GAIIP) — a new AI partnership to invest in data centers and supporting power infrastructure.

The announcement comes at a time when a surge in AI has led to a huge demand for the infrastructure that can sustain generative AI models. As a result, the sector is witnessing huge investments by big tech players and investors.

GAIIP will initially look to unlock $30 billion of private equity capital over time from investors, which in turn will mobilize up to $100 billion in total investment potential when including debt financing.

The group said that infrastructure investments will be chiefly in the United States while the remainder will be invested in U.S. partner countries. GAIIP will receive support from Nvidia Corp’s (NVDA) expertise in AI data centers and AI factories.

Larry Fink, Chairman and CEO of BlackRock said that mobilizing private capital to build AI infrastructure like data centers and power will unlock a multi-trillion-dollar long-term investment opportunity.

Meanwhile, Jensen Huang, founder and CEO of NVIDIA stated the firm will use its expertise as a full stack computing platform to support GAIIP and its portfolio companies on the design and integration of AI factories to propel industry innovation.

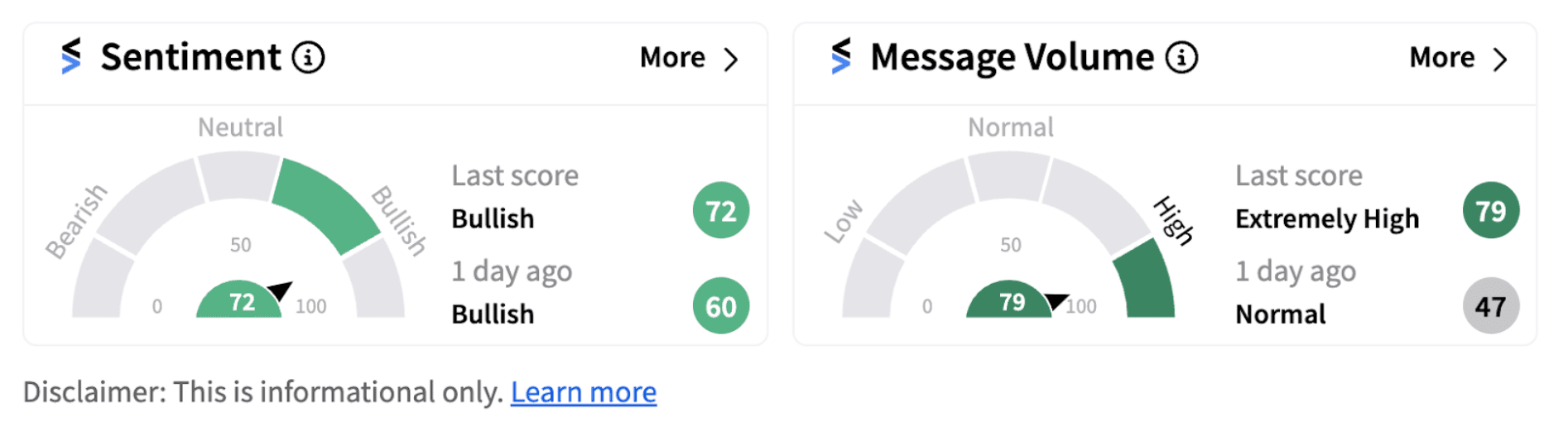

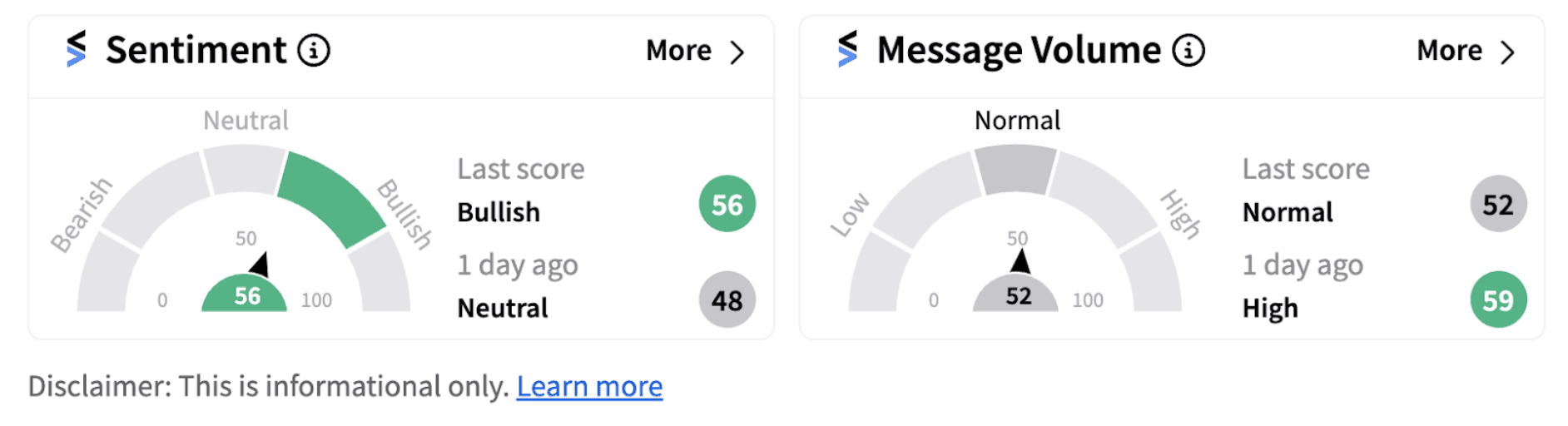

Following the announcement, retail sentiment for Microsoft inched-up higher into the ‘bullish’ territory (72/100) while for Blackrock, the metric turned ‘bullish’ (56/100) from ‘neutral’ a day ago.

Interestingly, BlackRock had announced in January, it will acquire GIP — one of the partners in GAIIP — for total consideration of $3 billion of cash and approximately 12 million shares of BlackRock common stock.

The transaction creates a multi-asset class infrastructure investing platform with combined client assets under management (AUM) of over $150 billion across equity, debt and solutions. Last week, BlackRock had notified that the acquisition is expected to close on Oct, 01, 2024.

Also See: Intuitive Machines Stock Skyrockets 52% After $4.82B NASA Contract Win: Retail Is Exuberant

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)