Advertisement|Remove ads.

Marvell Stock Spikes On CEO’s ‘Strong’ AI Demand Remarks: Retail Investors Pile In

Shares of Marvell Technology Inc. (MRVL) jumped over 8% on Friday, fueled by upbeat second-quarter results and optimistic commentary from CEO Matthew Murphy about the company’s growing AI-driven business.

After the market closed on Thursday, Marvell reported Q2 earnings per share of $0.30, matching analyst expectations, and sales of $1.27 billion, beating the $1.25 billion consensus estimate.

For Q3, the company expects earnings of $0.40 per share and revenue of $1.45 billion, both above Wall Street forecasts.

One of the standout highlights was Marvell’s data center revenue, which grew an impressive 92% on an year-over-year (YoY)basis to approximately $881 million.

“The demand has been extremely strong in the AI business… We see continued strength next year, some help in our above what we had communicated relative to the target for next year, both in custom and optics and the broader portfolio,” Murphy said on the earnings call. “Bookings momentum has been extremely strong, and we have a great setup here in the second half.”

Following the earnings report, at least seven Wall Street analysts raised their price targets on Marvell, based on the company’s impressive performance and optimistic outlook.

Barclays increased its price target to $85 from $80, noting that Marvell is “firing on all cylinders.”

Morgan Stanley, despite reservations on valuation, raised its target to $82 and highlighted that every business segment appears to have “turned a corner,” justifying the stock’s post-earnings surge.

Roth MKM kept a ‘Buy’ rating with a $95 price target but raised its FY25 and FY26 earnings estimates for the company.

Citi opened a “90-day positive catalyst watch” on Marvell, maintaining a ‘Buy’ rating and a $91 target. It expects further bullish commentary from Marvell’s management at its upcoming Global TMT Conference, with AI growth set to exceed prior targets.

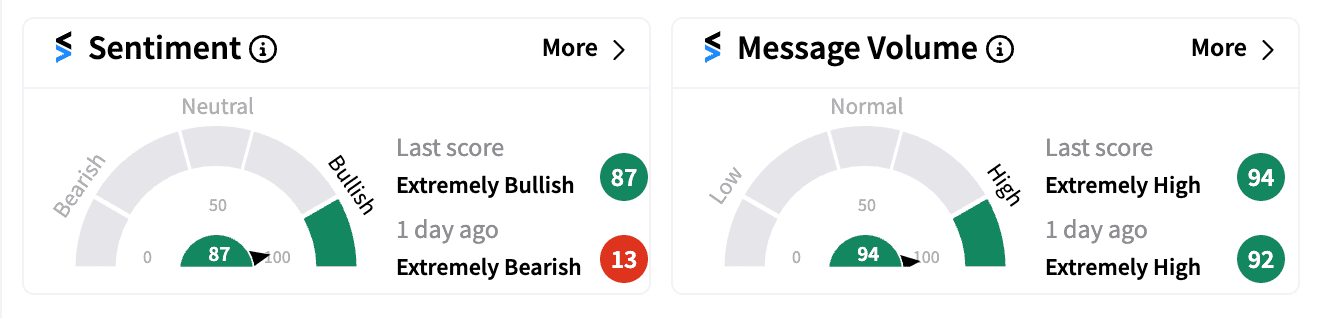

Retail investors are also riding the wave of optimism, with Marvell’s sentiment score on Stocktwits turning ‘extremely bullish’ (87/100) amid high message volume.

The stock has gained over 31% this year, outperforming both the S&P 500 and the Nasdaq. As AI demand accelerates, Marvell’s momentum seems poised to carry forward, offering an exciting prospect for both retail and institutional investors alike.

Read Next: Ulta Beauty Stock Dips On Disappointing Q2 And Outlook, But Retail Stays Bullish On Buffett Factor

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)