Advertisement|Remove ads.

Novo Nordisk Stock Attempts Rebound As CEO Prepares For Senate Grilling Over ‘Outrageous’ Wegovy, Ozempic Pricing: Retail Unfazed

Shares of Danish pharmaceutical giant Novo Nordisk (NVO) edged higher pre-market on Tuesday, attempting to recover from a nearly 3% drop in the prior session.

The market’s focus is on CEO Lars Fruergaard Jorgensen, who is set to testify later in the day before the U.S. Senate Health, Education, Labor, and Pensions Committee regarding the company’s pricing of its popular weight-loss drugs Wegovy and Ozempic.

The Senate committee has accused Novo Nordisk of charging “outrageously high prices,” pointing to stark price disparities between the U.S. and other countries.

Americans pay $969 per month for Ozempic, while the same drug costs just $155 in Canada and $122 in Denmark, the committee has argued. Wegovy’s price in the U.S. is $1,349, significantly higher than the $186 charged in Denmark or the $92 in the U.K.

Jorgensen has defended the pricing in past interviews, attributing the discrepancies to differences in insurance coverage across countries. He noted that many Americans with insurance pay just $25 per month for Wegovy.

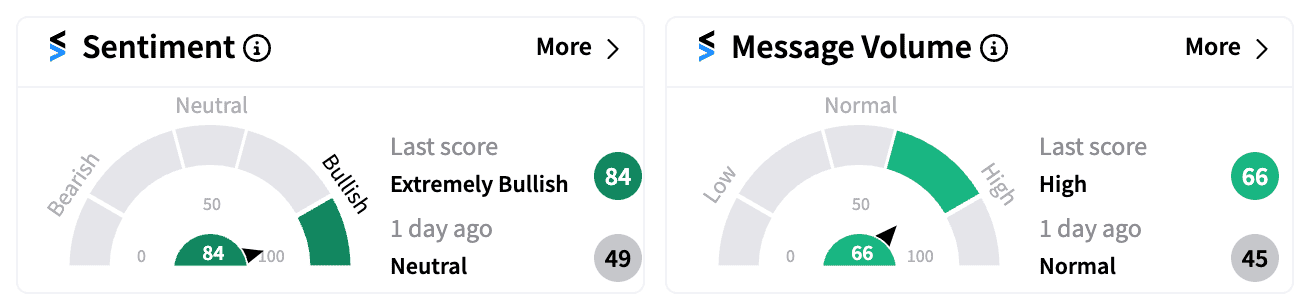

Despite the political scrutiny, retail investor sentiment on Stocktwits remains ‘extremely bullish,’ indicating that investors are confident the Senate hearing won’t have a severe impact on the stock.

Bloomberg recently reported that cumulative sales from Ozempic and Wegovy, which could reach $65 billion by year-end, are close to surpassing Novo Nordisk’s entire research budget for the past three decades. This fact could challenge the company’s argument that high prices are needed to fund innovation.

There are no generic alternatives to Ozempic in the U.S. market, further solidifying Novo Nordisk’s pricing power.

The financial burden of these drugs is significant: Medicare reportedly spent $4.6 billion on Ozempic alone in 2022, and a Senate report suggested that if half of all Americans took weight-loss drugs from Novo Nordisk and Eli Lilly, it could cost the U.S. $411 billion annually.

Despite the current challenges, Novo Nordisk’s stock has gained around 21% year-to-date, and the company maintains a market cap of nearly $413 billion.

Read next: NIO, Xpeng, Li Auto Stocks Surge Pre-Market As Retail Buzz Builds On PBoC Rate Cuts

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)