Advertisement|Remove ads.

Retail Investors On Stocktwits Have Never Been This Bullish On Shopify In A Year: Here's Why

Canadian multinational e-commerce firm Shopify (SHOP) topped analyst expectations on second quarter earnings and revenue causing the stock to jump over 23%.

Revenue rose 21% year-over-year (YoY) to $2.05 billion, beating an estimate of $2 billion while earnings per share (EPS) came in at $0.26 versus an estimate of $0.20.

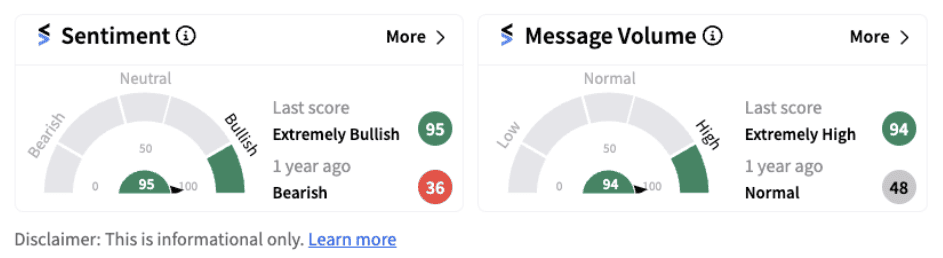

Following the announcement, retail sentiment on Stocktwits flipped into the ‘extremely bullish’ territory (95/100), hitting a one-year high, supported by ‘extremely high’ message volumes.

The firm reported a 22% rise in its gross merchandise value (GMV) at $67.20 billion. Its Merchant Solutions revenue rose 19% to $1.50 billion driven primarily by the growth of GMV and continued penetration of Shopify Payments. Subscription Solutions revenue rose 27% to $563 million, driven by growth in the number of merchants and pricing increases on subscription plans.

For the third quarter, the firm expects revenue to grow at a low-to-mid-twenties percentage rate on a YoY basis while gross margin is expected to be higher by approximately 50 basis points QoQ. The company expects GAAP operating expenses to be in the range of 41% - 42%. It also expects double-digit free cash flow margin for the rest of the year.

President Harley Finkelstein reportedly said during the earnings call that the firm is constantly evaluating and sharpening its marketing strategy, trying to find investments that will pay off over the next 18 months.

Stocktwits users are responding positively to the news and discussing the longer-term potential in Shopify. One user named ‘sterninvesting’ praised the management’s actions saying they are aligned with shareholder interest.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)