Advertisement|Remove ads.

Southwest Airlines Stock Faces Scrutiny As Elliott Pushes For New Leadership, Board Oversight

Activist investor Elliott Investment Management has told Southwest Airlines (LUV) investors in an open letter that the firm needs a new outside leadership and that Elliott is ready to engage with the company to discuss its future.

Elliott is increasing pressure on the company by proposing a new board-level committee to carry out a thorough business review and lead transformational change.

The activist investor also stated it is willing to meet the firm’s representatives on Sept. 9 but indicated that if the leadership can’t figure out what’s best for the company and its stakeholders, it will go ahead with the board challenge.

"...when we encounter corporate executives who believe that the companies they run are their personal fiefdoms and that they are entitled to run them – and to be paid handsomely to run them – unchallenged for as long as they want, no matter what results they deliver, then we are more than happy to provide a voice for those whose interests are being poorly served," Elliott said in the letter.

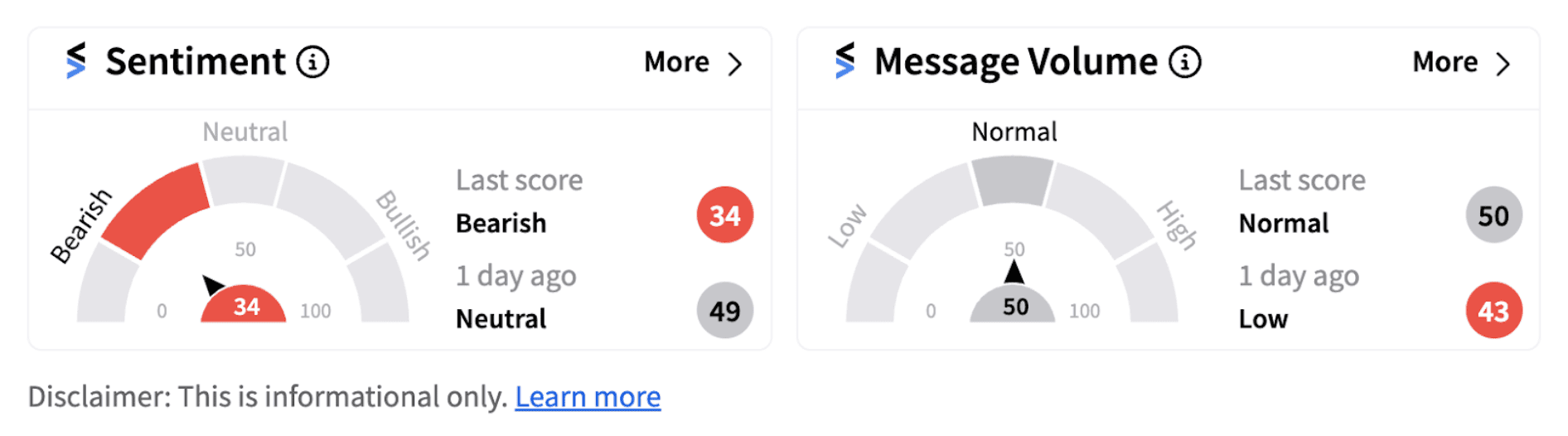

Following the development, retail sentiment on Stocktwits dipped into ‘bearish’ territory (34/100) from ‘neutral’ zone.

According to a release issued by Elliott two weeks ago, funds managed by the activist investor own a 11% stake in Southwest Airlines. Elliott said it intends to nominate 10 independent, highly qualified candidates to the company's board and plans to move forward expeditiously to formally nominate the candidates.

The activist investor had outlined three steps to restore Southwest’s leading position that included reconstituting the firm’s board, installing new leadership, and conducting a comprehensive business review.

In response, Southwest Airlines said its board and executive leadership team remain open to conversations with Elliott to discuss ideas to drive shareholder value, and that the board will evaluate Elliott's proposed nominees as part of its ongoing board refreshment process.

Southwest Airlines’ latest quarterly report was not quite upbeat. The firm’s Q2 net income fell 46.3% to $367 million and the company said it was taking steps to mitigate near-term revenue challenges and implement longer-term transformational initiatives. Operating revenue came in at a record $7.35 billion, in line with a Wall Street estimate while earnings per share (EPS) came in at $0.58, higher than an estimate of $0.52.

The company expects Q3 unit revenue to be in the range of flat to down 2% on a year-over-year (YoY) basis with capacity up roughly 2%.

The coming days will reveal if Southwest Airlines meets Elliott's demands or if the conflict escalates into a boardroom battle. With Elliott already holding about 11% of the company, it also remains to be seen if the activist investor increases its stake or if other major shareholders decide to get involved.

Also See:

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitdeer_0adcf9a760.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254687746_jpg_9f8228b6ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cfpb_resized_png_ad08d8de38.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_52154609_jpg_bc5ad676b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nvidia_jpg_7ed87bb07c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)