National gas prices reached a new record, hitting $4.67 as of Wednesday, leaving consumers and businesses on the hook ahead of the summer travel season. ⛽

This week’s EIA report showed that inventories continue to fall, and President Biden appears to have conceded that the government can do anything to bring down gas or food prices in the near term. 👎

The White House has already tapped its strategic reserves and asked U.S. producers to ramp up production, but those efforts have provided little relief. Nor has the administration’s bigger-picture plan, which it presented in March. 📅

This week’s solutions included an oil profits tax/consumer rebate and a possible trip to Saudi Arabia to try to advance Middle East peace prospects, which could help calm global oil markets. 💡

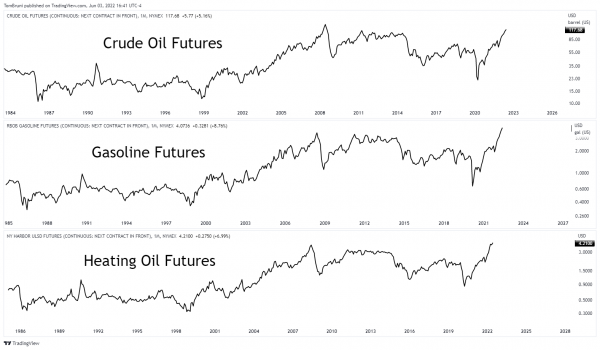

So far, the market isn’t buying any of these fixes. Instead, this week saw crude oil, gasoline, and heating oil futures rally further to fresh highs. 📈

Not even news that OPEC-plus agreed to increase output could budge markets. 😩

While the solutions to this problem remain a mystery, what’s clear is that high fuel prices will remain a key focus well into the summer and mid-term elections. 💭