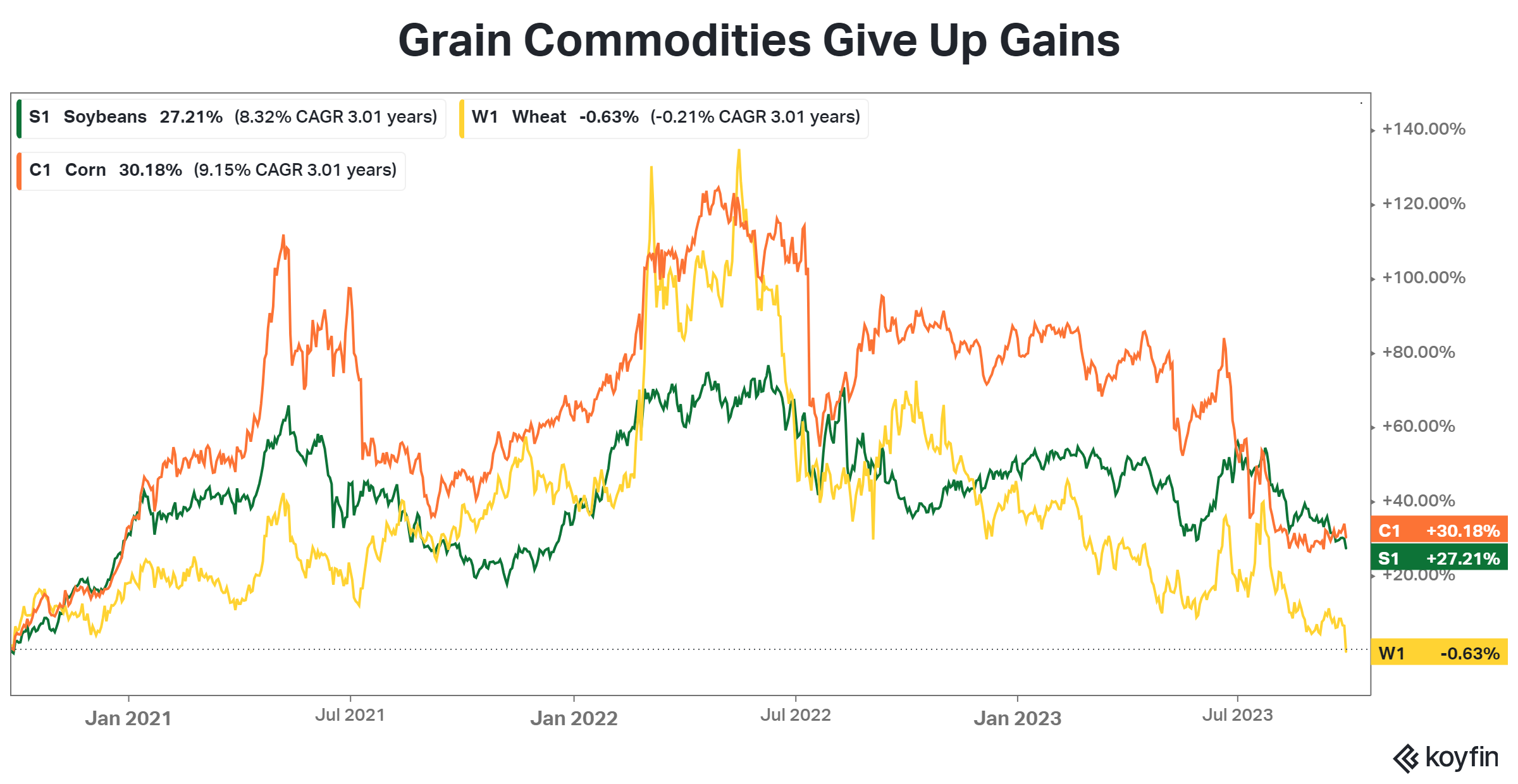

Grain commodities were the talk of the town for a bit during the pandemic, as soaring prices pushed up producer and consumer inflation. They’ve not gotten a lot of headlines lately, as a slow and steady decline is less interesting than a sharp increase. 😴

However, they were back in the news today after making a swift move lower. The USDA quarterly grain stocks report showed higher stocks and production than initially anticipated. Wheat was hit the hardest, though soybeans and corn were both down too. 📉

We get an accurate picture of the current trend by pulling back our lens to the last three years. After gaining nearly 140% during the pandemic, wheat has given back all of its gains, with corn and soybeans now up moderately.

Why does this all matter if you don’t trade or invest in these commodities? Well, from an inflation perspective, lower commodity prices are a significant tailwind for future inflation readings. Yes, many commodities rose sharply during the pandemic due to supply issues, but now they’ve all come down significantly from those highs. And that’s good news for inflation. 👍

The last major piece of the puzzle remains energy, which has seen steep gains throughout the summer. We’ll have to “wheat and see” how that develops into year-end, but pricing pressures should continue improving on the agricultural commodity side of things. 🤷