With the stock market catching its breath before a new earnings season begins, we’ve been trying to highlight other market trends. And right now, one of those is in the precious metals section of the commodities space. 👀

Gold, silver, platinum, and palladium are all considered precious metals for those unfamiliar. These metals are rare, naturally occurring metallic chemical elements of high economic value…hence the name. *cue the Gollum “my precious” meme.*

While these are all important for economic purposes…making their way into technology, consumer goods like jewelry, and elsewhere, they’re not like base metals copper, nickel, aluminum, etc., that primarily serve an industrial need. 💍

In the investment world, they’re often included in people’s portfolios as an “inflation” or “end of the world” hedge. As a real asset, the theory is that these physical goods of high value should go up in value during times of economic uncertainty or high inflation. That theory, while logical, doesn’t always hold up when looking at the data. However, it’s still a core investment pitched to investors, professional and retail alike. 🪙

So why are we talking about precious metals today? Some investors in the community have recently highlighted the slowly declining price action over the last few weeks.

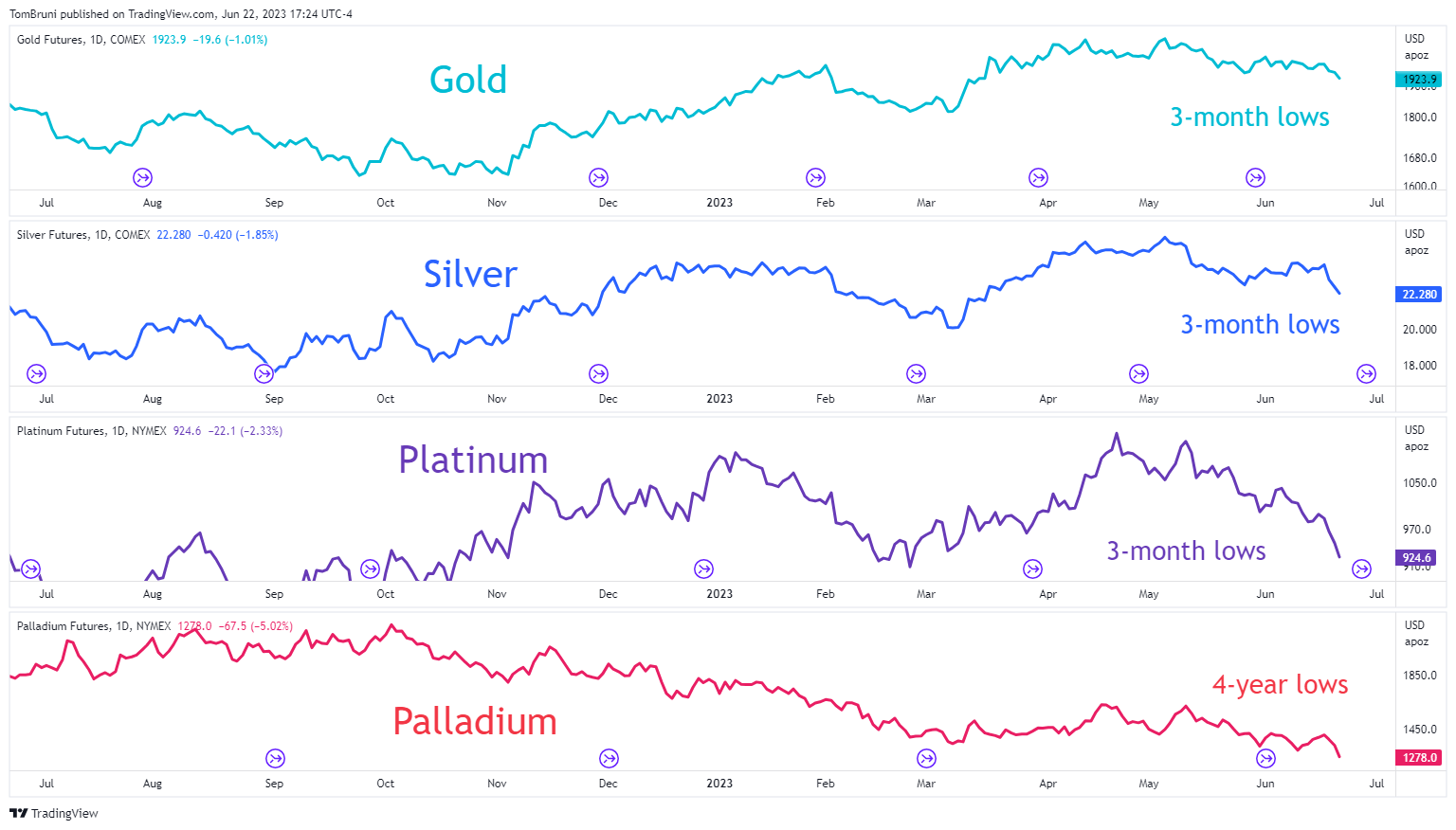

Below is an overlay chart of gold, silver, platinum, and palladium. As we can see, gold has held up the best but is still hitting three-month lows, along with silver and platinum. Meanwhile, palladium made fresh four-year lows this week. 👇

Now this doesn’t necessarily imply that prices will continue lower. But with inflation coming down and a lot of the economic uncertainty being removed from the market recently, it’s not surprising to see these tangible assets start to move lower. 🔻

The current backdrop is causing many investors to rethink where this group could be heading in the short to medium term. As such, this chart will undoubtedly be on investors’ radars as we head into the second half of 2023.

As always, we’ll keep you updated on how this short-term trend develops. But for now, traders in the community are bracing for a test of those March lows. 😬