Market participants love to trade what’s moving. And sometimes stocks move for very interesting reasons. Let’s take a look at two examples from today. 👀

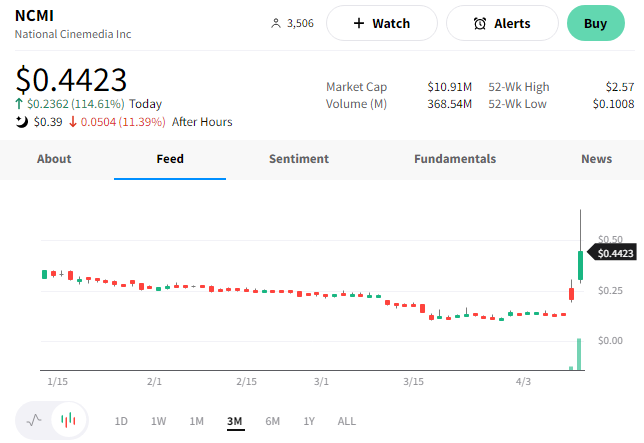

First up is National CineMedia, which filed a voluntary Chapter 11 petition. The largest movie-theater advertising business in North America has entered into a restructuring agreement with its lenders. This follows news that one of its largest shareholders and customers, Regal parent Cineworld, has presented a restructuring plan of its own to emerge from bankruptcy. 🎥

Under the restructuring agreement, NCM’s secured lenders will convert all its debt into equity. And its listed holding company, National CineMedia Inc., will receive an ownership interest of 14% in the restructured entity. National CineMedia’s bankruptcy filing listed estimated assets of $500 million to $1 billion and liabilities of $1 billion to $10 billion. 📝

Overall, the prospects for movie theatre-related businesses have improved. However, they still have a long way to go before getting back to pre-pandemic levels, if they do at all. With that said, market participants are clearly taking this opportunity to trade these stocks while there’s volatility.

Despite the bankruptcy filing, $NCMI shares have rallied sharply over the last two days. Yesterday’s news that AMC Entertainment Holdings became the company’s second-largest shareholder sent shares higher initially. And today’s restructuring plans caused another 100%+ rise. 😮

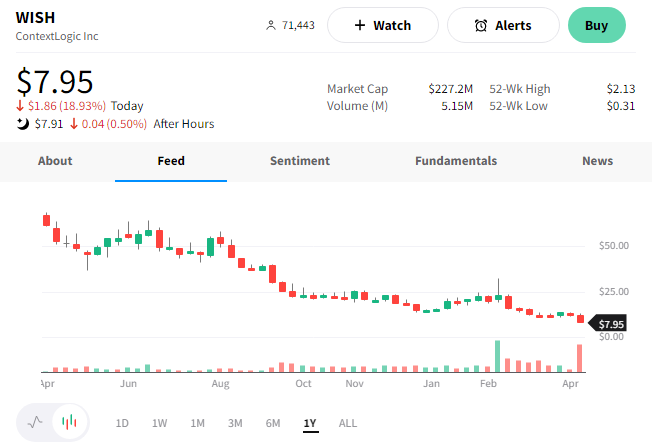

Next up is ContextLogic, better known as Wish. 🛒

The struggling mobile e-commerce platform announced a 1-for-30 reverse split of its shares yesterday, with post-split pricing beginning today. While a reverse split does not technically change the capital structure of a company, it’s usually not done by firms who are crushing it.

Instead, it’s often used by firms at risk of being delisted by the exchanges for falling below minimum share price requirements. Additionally, it gives management more room to raise equity capital. And that’s why shares often fall post-reverse-split, as investors price in potential share dilution. 🔻

Clearly, it’s been a rough ride for the company. $WISH shares have given back all the gains from Citron Research’s positive note as investors refocus on its core business fundamentals. Maybe this reverse split could be the catalyst for its turnaround. Based on today’s action, however, most investors see that as wishful thinking. 🤷