Price Levels To Watch This Weekend For Polkadot And Basic Attention Token

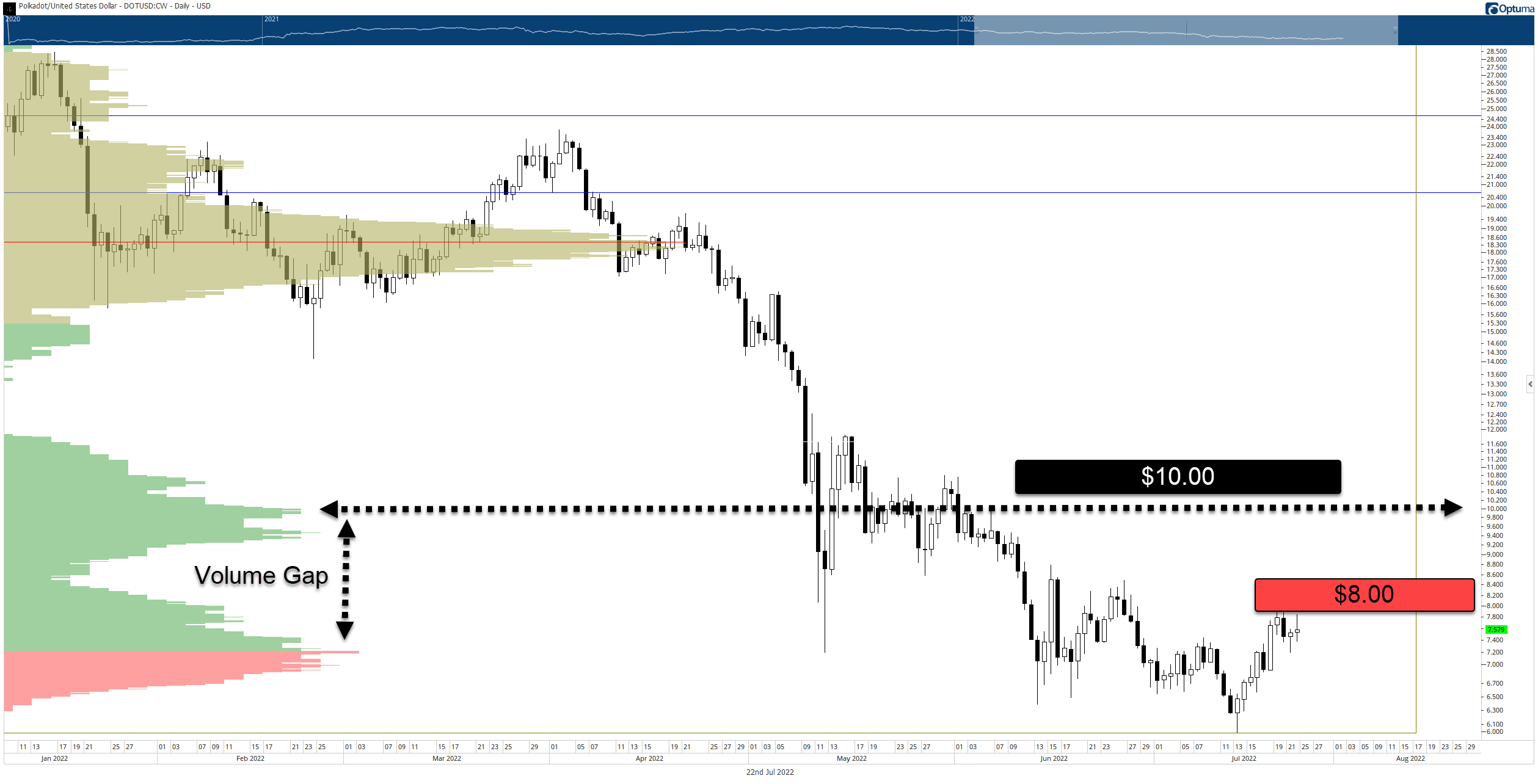

Polkadot ($DOT.X)

Bulls show some difficulty moving above the $8.00 value area. However, if bulls close DOT at or above $8.00, analysts suggest a fast move higher through a gap in the volume profile may occur before finding resistance at the next high volume node and psychologically important $10.00 value area.

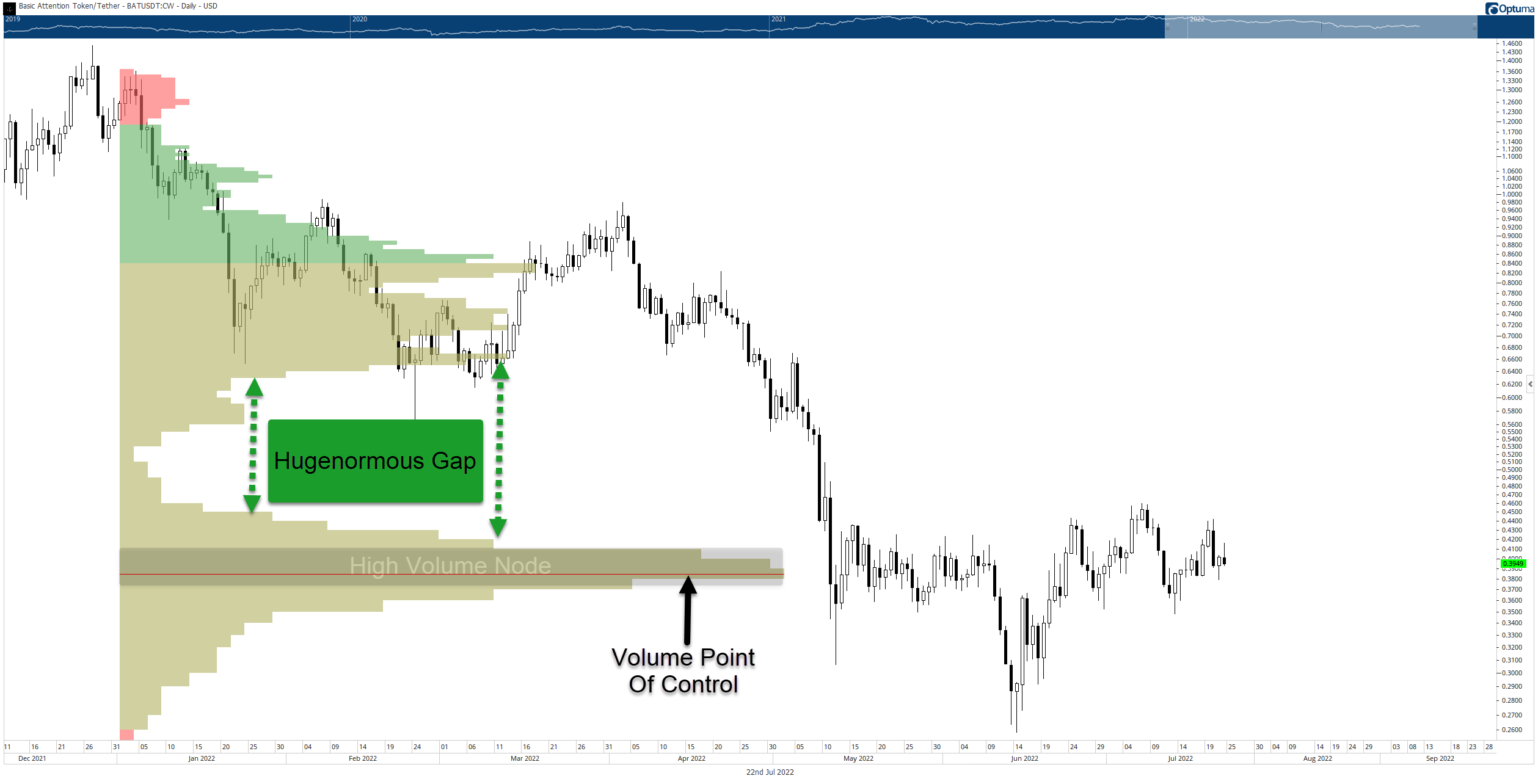

Basic Attention Token ($BAT.X)

The very thin red horizontal line in the volume profile is known as the Volume Point Of Control (VPOC). The VPOC represents the price level where the most buying and selling has occurred and is interpreted by analysts as one of the most important support/resistance levels on a chart.

BAT is trading slightly above the VPOC but inside a high volume node (the long horizontal blob of yellow). Analysts are watching for any daily close below $0.34 because there is no volume profile support below that price level, indicating a fast move lower may occur.

Conversely, analysts are watching for any daily close above $0.45. The volume profile is extremely thin above $0.45. Analysts interpret large gaps in the volume profile as areas of easy movement.

When price moves above or below a high volume node into a gap, it gets sucked towards the next high volume node like a vacuum. For Basic Attention Token, analysts warn that BAT could spike towards the $0.55 to $0.60 value area. 🪙