If you look at any crypto news site or social media, a frequent question is: “Will it keep moving higher?” 😐

Analysts across the board have strong arguments for bullish and bearish outlooks. We’ll look at some of those outlooks, using $BTC.X as the ‘barometer’ of how the broader crypto market moves.

First Thing First

Remember this chart from September 2, 2022?

The September 2, 2022 Litepaper had this commentary accompanying this chart:

“In either scenario, 2023 will be critical for Bitcoin within the Ichimoku system. Because in order for Bitcoin to maintain a clear and strong bullish trend, it will need to remain above the monthly Cloud.

The bottom of the monthly Cloud for 2023 starts at $10,000 and then moves dramatically higher until it reaches $33,000 in June 2023 before slowly increasing towards the $34,400 level in December 2023.” – September 2, 2022, Litepaper.

Fast forward to the January 4, 2023 Litepaper and we reviewed this chart below:

In the January 4, 2023, Litepaper, the following commentary accompanied the above chart:

“From an Ichimoku perspective, Bitcoin is sitting in a position that makes me want to nerd out – the next three months are going to be exciting to watch.

Why? Because of Patel’s Two Clouds Theory (at least, that’s what I call it).

In Manesh Patel’s book, Trading with Ichimoku Cloud: The Essential Guide to Ichimoku Kinko Hyo Technical Analysis, Patel calls attention to an Ichimoku phenomenon that no other modern Ichimoku analyst has called attention to in book form. This is what he observed:

When a major trend change occurs, the Future Cloud is thin, with both the current Senkou Span A and Senou Span B pointing in the direction of the Cloud.

It’s a rare condition that is currently present on Bitcoin’s monthly chart:”

That brings us to Bitcoin’s monthly chart so far for this month 🏃:

There’s been a gigantor rally so far in January, giving Bitcoin a nearly +30% gain (so far). And if Bitcoin closes this month anywhere above $20,495, it will be the highest close since July 2022.

For bullish Ichimoku analysts, the path to $27,750 appears wide open for two primary reasons:

- A strong response of the Kumo Twist with a bounce off the Cloud.

- The large gaps between the bodies of the candlesticks and the Tenkan-Sen remain unresolved.

For the bears, it’s a waiting game. Bitcoin must close January at or above $21,300, or else Bitcoin will open February below the Ichimoku Cloud for the first time since January 20, 2021. 😱

Polkadot and Solana Update

This is an update on the $DOT.X and $SOL.X analysis from Wednesday’s Litepaper.

Polkadot’s chart from Wednesday:

The primary level that the bullish analysts and traders have been looking at is currently breached – but the day and week aren’t over yet.

As discussed on Wednesday, bulls need to push for a close above $5.90 to move above the Cloud.

Bears continue to watch the Chikou Span for rejection at $6.19 – if DOT can make it there.

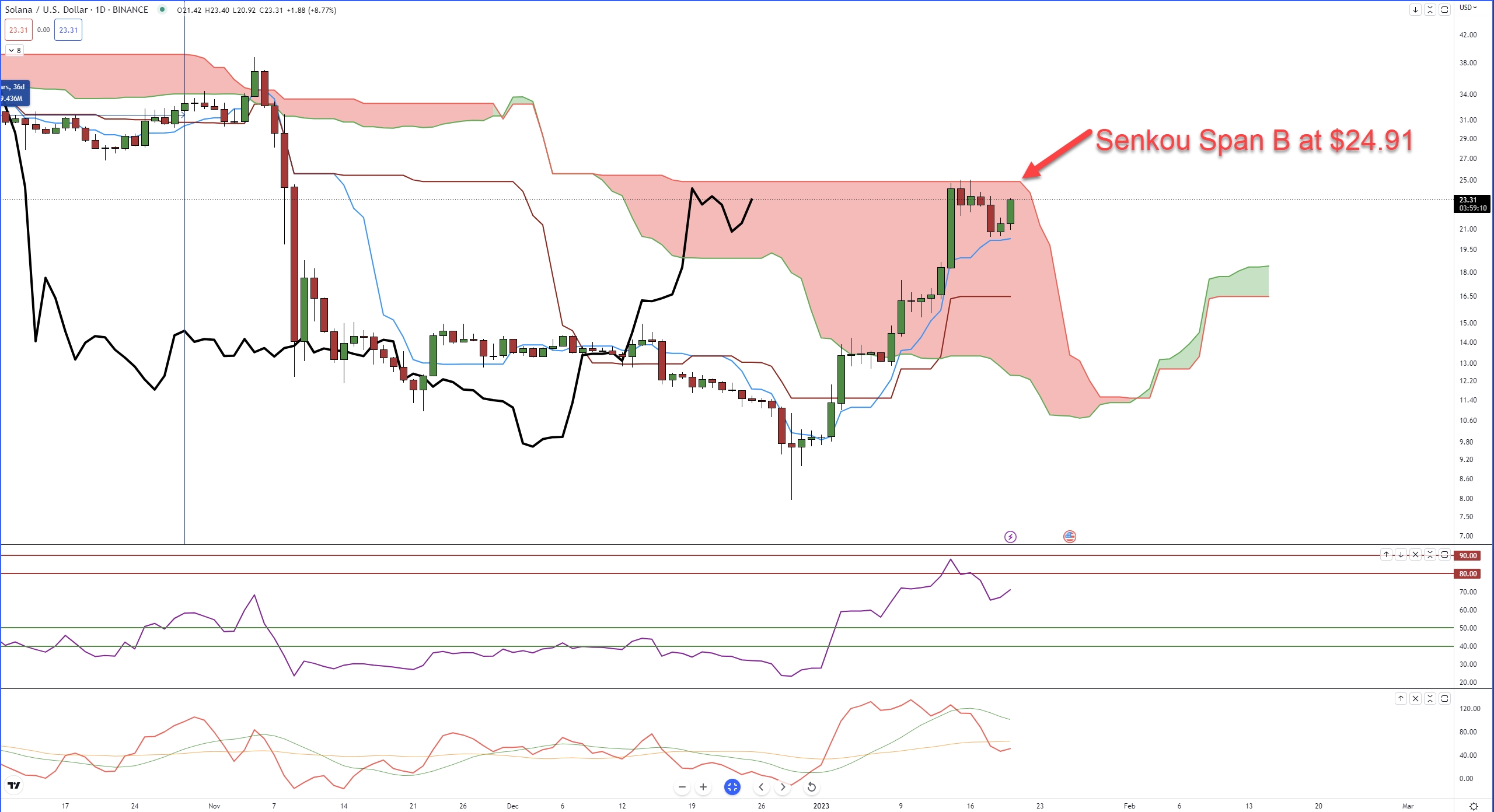

Then we’ve got Solana’s chart from Wednesday:

Solana’s had a nice bounce today, hitting close to +9% higher at the time of writing.

But it’s in a precarious position: the top of the Cloud, Senkou Span B at $24.91 might be a tough nut to crack even if the broader market continues to rally. We’ll keep a close eye on it. 👀